Net Revenue Retention (NRR): Formula and Benchmarks

This blog is your guide to know and understand Net Revenue Retention (NRR) of your income statement that represents the complete business value of your company’s existing customers ONLY.

That’s right.

No calculations of new sales or marketing budgets for flashy new customers, just you and your existing customers – the potential goldmine of your business

Net Revenue Retention (NRR) or Net Dollar Retention (NDR) is the metric in spotlight and is one of the most important statistics to business analysts especially to the ones in SAAS sector.

Net Revenue Retention shows how successful your business is maintaining and growing revenue from its customer base and does not focus on growth metrics from new customers. This blog post will explain why NRR is important and show you how to calculate net revenue retention in detail. We will also discuss the components of NRR calculation and talk about how important NRR Rate is in different business settings especially in SaaS industry.

What is Net Revenue Retention (NRR)

Net Revenue Retention (NRR) is the retained revenue from existing customers over certain duration of time. It represents how much recurring revenue was contributed by existing customers at the start and end of certain duration, after adjusting upgrades, downgrade and customer churn.

NRR adds revenue from existing customer base and the revenue earned from up-selling or cross-selling to the same customers.

NRR subtracts any revenue lost from customer churn and product downgrades.

NRR tells you how much your existing customer base is growing or shrinking.

NRR can be calculated for specific markets, customer segments, campaigns or business seasons.

For subscription-based organizations, achieving a good NRR rate is essential.

Related Read: Is net sales the same as revenue

What is Net Revenue Retention Rate – NRR Rate

NRR Rate is the percentage (%) calculation of NRR. NRR rate provides a more complete picture of revenue behavior and growth within your present customer-base without relying on new customers.

It gives you a clear picture whether your company is growing, shrinking or staying steady based solely on existing customers.

Related Read: Churn rate vs Retention rate

How to Calculate Net Revenue Retention Rate

The formula of net revenue retention includes five components.

Net Recurring Revenue

MRR lost from churned customers

MRR from downgrades

Revenue from upgrades

Base Recurring Revenue

Net Revenue Retention Formula

The formula for calculating NRR is:

NRR = (Net Recurring Revenue – MRR lost from churned customers - MRR from downgrades + Revenue from upgrades)/

(Base Recurring Revenue X 100)

Components of Net Revenue Retention Formula

The five components of calculating NRR are a bit technical but are very easy to understand. Below is a brief description of each so that you understand how to use NRR formula efficiently.

Net Recurring Revenue: is the net increase in revenue from existing customers at the END of a specific time period.

MRR lost from churned customers: it is the Monthly Recurring Revenue (MRR) lost from churned customers – also called Churned MRR

MRR from downgrades: it is the MRR lost when same existing customers downgraded the product or service in use – also called Contraction MRR

Revenue from upgrades: it is the revenue gained from upgrades taken by existing customers – also called Expansion MRR

Base Recurring Revenue: is the recurring revenue from the existing customer at the beginning of the specific time period.

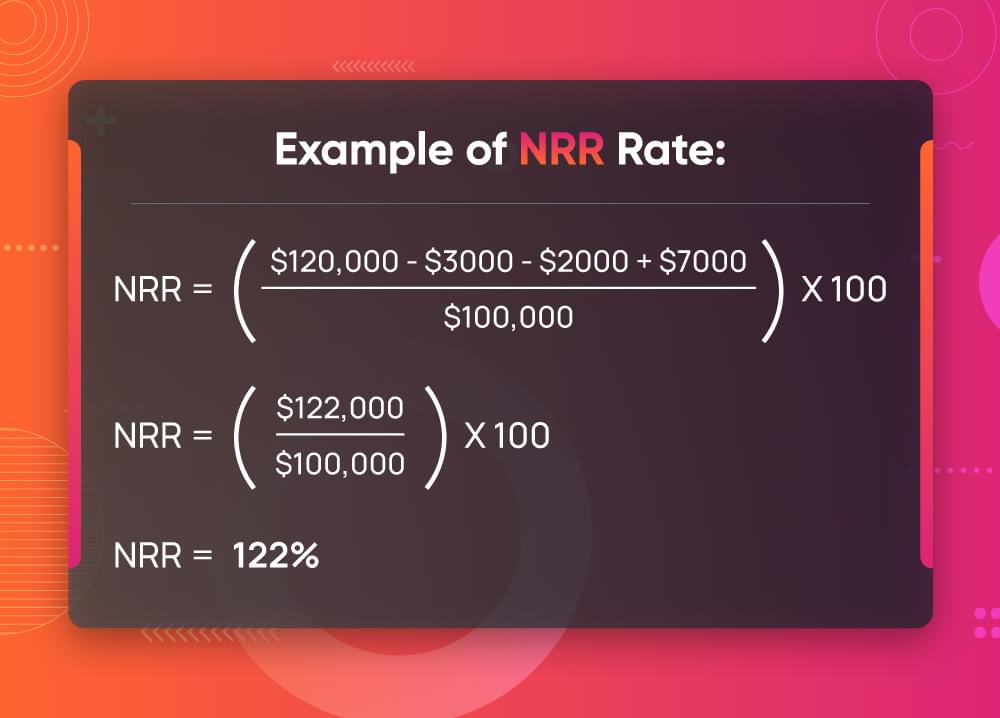

Example of NRR Rate:

Let’s understand what the formula to calculate NRR is, and its components with the help of an example.

Imagine a company had $100,000 in recurring revenue from existing customers (Base Recurring Revenue OR Starting MRR) at the start of May. During May, it lost $3000 due to customer churn (MRR lost due to customer churn OR Churned MRR) and $2000 due to downgrades (MRR from downgrades OR Contraction MRR). However, it generated $7000 due to upgrades (Revenue from upgrades OR expansion MRR). From the same customers the overall revenue earned at the end of May was $120,000 (Net recurring revenue).

Let’s use the NRR formula and calculate.

NRR = ($120,000 - $3000 - $2000 + $7000) / ($100,000 x 100)

NRR = $122,000 / ($100,000 x 100)

NRR = 122%

So the company has a Net Revenue Retention Rate of 122% saying that despite losing some customers and some service downgrades, the revenue earned from existing customers of this company was more than the start of the month.

In short, the NRR formula uses the increase in net revenue from a company’s current customers at the end of a specific time and divides it by the revenue from the same customers at the beginning of the specific timer period. It includes the changes in revenue that happened from expansion, customer churn or downgrades and from upgrades.

Depending on what business model a company uses and what its needs are, NRR can be calculated on daily, monthly, quarterly or annually basis.

If you track NRR separately, you can leave churn and use expansion only however, as a CEO or an investor, you never want to be surprised especially when it comes to customer churn. So to avoid any misleading situation, keep a check on gross revenue retention (GRR) alongside net revenue retention (NRR).

Related Read: Gross sales vs net sales

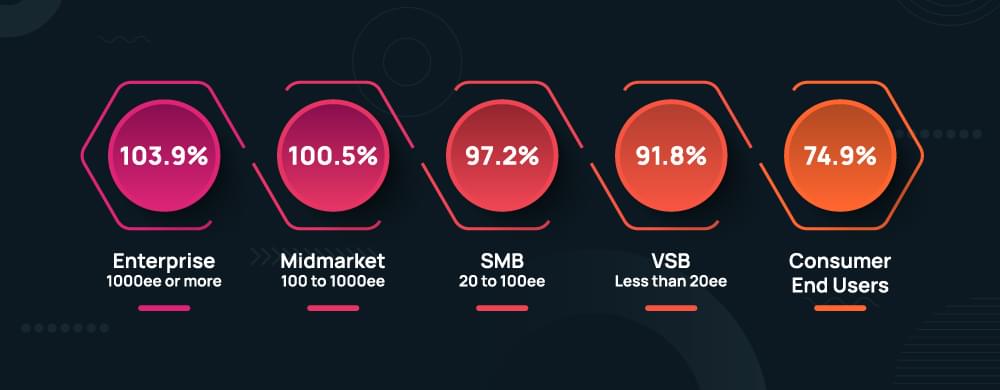

Net Revenue Retention Rate Benchmark

NRR benchmarks are a set of industry standards that companies use to compare their performance with their competitors. NRR benchmarks are based on data from companies with similar business models or same industry. These benchmarks vary from industry to industry.

If you are in a SaaS business, compare your current NRR to historical NRR and NRR benchmarks of industry. This will give you a better picture of your company’s retentions and growth trends.

What is Good Net Revenue Retention Rate

An NRR rate above 100% is considered good Net Revenue Retention Rate. According to advisor Dave Kellogg, a good median NRR for private companies is 104%.

However, the standard varies from industry to industry, here’s why:

NRR Rate below 100% is considered trouble as it shows that your existing customer base is shrinking and that you have high churn rate or contraction / downgrades of product or services. You need to investigate the exact cause of this low NRR Rate and take actions accordingly. May be you need to work on handling customer complaints since NRR Rate heavily depends on customer support.

NRR Rate between 100% - 120% is considered a good range of NRR Rate. It indicates that you are not only maintaining but also modestly increasing your earnings from current clients without bringing on new ones. The upgrade strategies are working fine and customers are loyal and satisfied of your product or service.

NRR Rate Above 120% is considered excellent. It indicates that your company is experiencing high growth rate from within since its up-selling and cross-selling techniques are booming and your customer base is highly satisfied with your services. Companies with an NRR Rate above 120% are often market leaders with a strong product-market fit.

How to Increase Your Net Revenue Retention Rate

High NRR rate is crucial to all business, although SaaS business models heavily rely on metrics like company’s monthly recurring revenues (MRR) thus there can be many ways to increase the NRR rate directly by working to acquire new customers or indirectly by customer retention management.

But following are some industry-wide tested ways to increase Net Revenue Retention Rate.

Align Your Focus with Customer’s Business Value – “know thy customer”

Your customers chose your product or service when they were sure that it will bring value to their business. Find that value and capitalize on it – build engagement strategies and support programs accordingly.

A good starting point is to first segment your customers based on their business value (you can primarily focus your high-value customers but not necessarily). Design and implement the engagement strategy that is carefully crafted to work for that customer cohort. Maintain regular communication via newsletters, product updates, webinars or even personal check-ins. Focus on delivering product value as early as possible. Now monitor your product usage and implement customer support strategies, close the cycle with customer feedbacks and surveys.

Research shows that companies that align their engagement strategies with customer value see a 20% increase in their net revenue retention (NRR) rate, as they equip better to cross-sell and upsell to their existing customers.

In addition to building value-based customer cohorts, NRR driven companies use other customer segmentation strategies based on monetary-values, common demographics, recency and frequency based, and customer needs-based segmentation etc.

Know Customer Health Score for Bonus Product Expansion

From Net Revenue Retention Formula we know that expansion revenue is a key to achieve high NRR. However, expansion discussions with your customer need to be done at the right time – too soon, and the customer questions your intentions – too late, and it’s no good anyways.

To avoid similar situations, use customer health scoring programs that will measure their likelihood to grow or churn. Customer success teams need to know the right time to have expansion conversations with customers. These programs identify the traits and behavior pattern of your most (and least) successful customers. Each factor is assigned a point value based on how much it impacts a customer’s health. Use these scores to perfectly time their expansion outreach by monitoring buying signals such as renewal time, increased usage or support request, survey results, engagement and more.

Invest in Customer Success Teams and Incentivize them

Your Customer success teams are the face of your company and they bring a bigger piece of revenue. Customer’s expectation for SaaS products and service interactions will only rise when your customer success teams are working on their full potential. Unfortunately, not many businesses realize it and according to Gartner research, only 15% of customer interactions add value to customers. Therefore, it is important that management support their CS teams through investing more resources and tools for customer satisfaction and growth.

Similarly, to help focus you customer success team’s efforts on proactively identifying upsell, cross-sell and growth possibilities with customers, add a variable pay component. This team structure links individual responsibilities to the team’s overall objectives and gives a sense of purpose and responsibility to everyone across the board.

Invest in Product Development

Never Stop your Product Development Process

Continuously improve your product based on market trends and customer feedback. You can use services like churnfree.com to do surveys and get feedbacks customized as per your needs. The results can bring you enough data to identify your customers’ pain points. Focus on developing features in your product that solves their matters and improve their use of your product as a whole.

The bottom-line

Focusing on improving Net Revenue Retention Rate can give you long-term business growth, less reliance on existing customers and build a loyal and satisfied customer base. Implement customer health score techniques and use churn management software like Churnfree to help you understand the potential bottlenecks coming your way.

NRR is more than just a statistic – it is like having a finger on the pulse of your existing customers. Whether you are a startup looking to scale or an established running business aiming to maintain growth, focusing on NRR can help you get on to the right path – the path of more expansions, revenues and customer loyalty and less downgrades / contractions and churn. Sharing some related guides you might be interested in :

Customer retention strategies

What is the most direct cause of customer loyalty

Gross vs Net Retention

FAQs

Does Net Revenue Retention Include New Customers?

No, NRR does not include revenue from new customers.

It focuses exclusively on the revenue from current customer base. It is a crucial calculation to measure customer loyalty and product value. If NRR Rate is high then it means that your customers are happy and they see value in your product.

Define Net Revenue Retention vs Net Dollar Retention

Net Dollar Retention is the other of Net Retention Revenue and there is no difference.

What team should own NRR?

Your Customer Success (CS) team should own NRR. This team is responsible for renewals, expansion and growth. Customers Service team, Support team, Product team, Sales team, Marketing and Finance teams are all considered to be part of Customer Success team.