Average Benchmarks and Customer Acquisition Cost for SaaS in 2024

Let’s be real – running a SaaS business can sometimes feel like throwing money into a black hole and hoping for the best. Between marketing campaigns, sales team salaries, and onboarding processes, costs pile up faster than you can say “CAC.” But I tell you something: behind every new customer lies an invisible cost that can make or break your business: customer acquisition cost (CAC) – the same is true for any SaaS business.

In this post we will see why Customer acquisition cost varies so much in SaaS business and how to spend smartly – not just spending big. Whether you are a startup founder trying to break even or a mature SaaS company looking to maximize ROI, this is your go-to guide for keeping CAC in check and turning your spending into profits. To understand the complete customer acquisition process, click here.

Related Read: What is Customer Acquisition

What is the Average Customer Acquisition cost for SaaS

The average CAC for SaaS industry is $702. However; there is no exact average cost in SaaS or other businesses because every business is different. Those who would give a figure are guessing. However, to keep specific benchmarks in the industry, these calculations are made, and businesses do benefit from them. Consider this example before to get the basic idea and the the details later in the blog will clarify it in detail.

If you spend $10,000 in sales and marketing to acquire 1000 users, your average CAC is $10 per user.

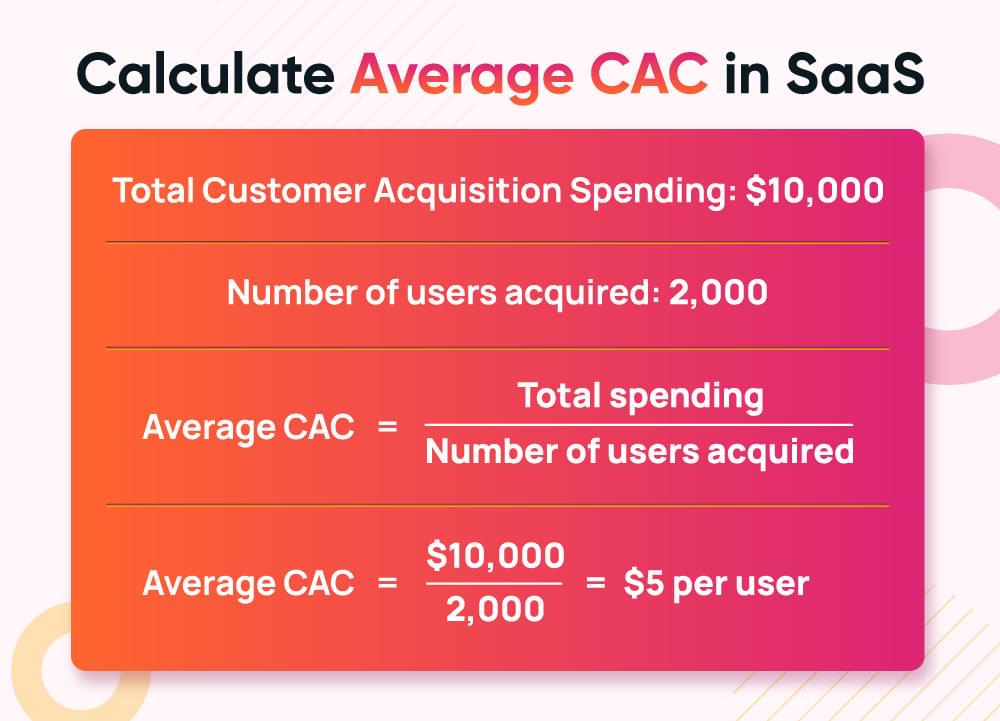

How to Calculate Average CAC in SaaS

Let’s define some terms before we get into the nitty-gritty of this calculation.

Customer Acquisition Cost (CAC)

Customer acquisition cost CAC is the cost a company bears to acquire a new customer. Customer acquisition cost is the sales and marketing costs for acquiring a user. This includes but is not limited to content marketing costs, ad spending, SEO and marketing costs, salaries for sales and marketing teams, etc.

Average CAC

If you spend $10,000 in sales and marketing to acquire 1000 users, your average CAC is $10 per user.

Customer Life Time Value (LTV)

Customer lifetime value (LTV) is how much you can earn from a customer over the time they spend on your product. If, on average, your customers stay for six months with a monthly subscription of $100, your customer LTV is $600.

Average Cost of Servicing (ACS)

Average Cost of Servicing (ACS) is the cost acquired in servicing a customer, including product development and other organizational costs, but excluding the sales and marketing expenses. These costs include customer support, product development, account management, etc.

CAC Payback Period

The CAC payback period is the amount of time needed to recoup the cost of gaining a customer. Ideally, SaaS companies aim for a payback period of 12 months or less.

Let’s understand the calculation with an example.

This means that, on average, it costs your business $5 to acquire one new user.

Related read: What is customer acquisition cost

Average Customer Acquisition Cost SaaS

Here’s a table showing you the industry standards with regard to the average customer acquisition cost for SaaS according to FirstPageSage

| SaaS Industry | LTV Bencmark | CAC Benchmark | LTV:CAC Ratio |

|---|---|---|---|

| Adtech | $6,800 | $956 | 7:1 |

| Business Services | $2,400 | $787 | 3:1 |

| Cybersecurity | $15,500 | $3,441 | 5:1 |

| Edtech | $7,100 | $1,431 | 5:1 |

| Fintech | $11,700 | $2,496 | 5:1 |

| Medtech | $16,300 | $3,665 | 4:1 |

Keep reading, and we will discuss the CAC ratio and benchmarks later in the blog.

What is a Good CAC in SaaS

To understand the average CAC in SaaS, a better approach would be to identify a good CAC based on other aspects of your product, such as Customer Lifetime Value and Average Cost of Servicing.

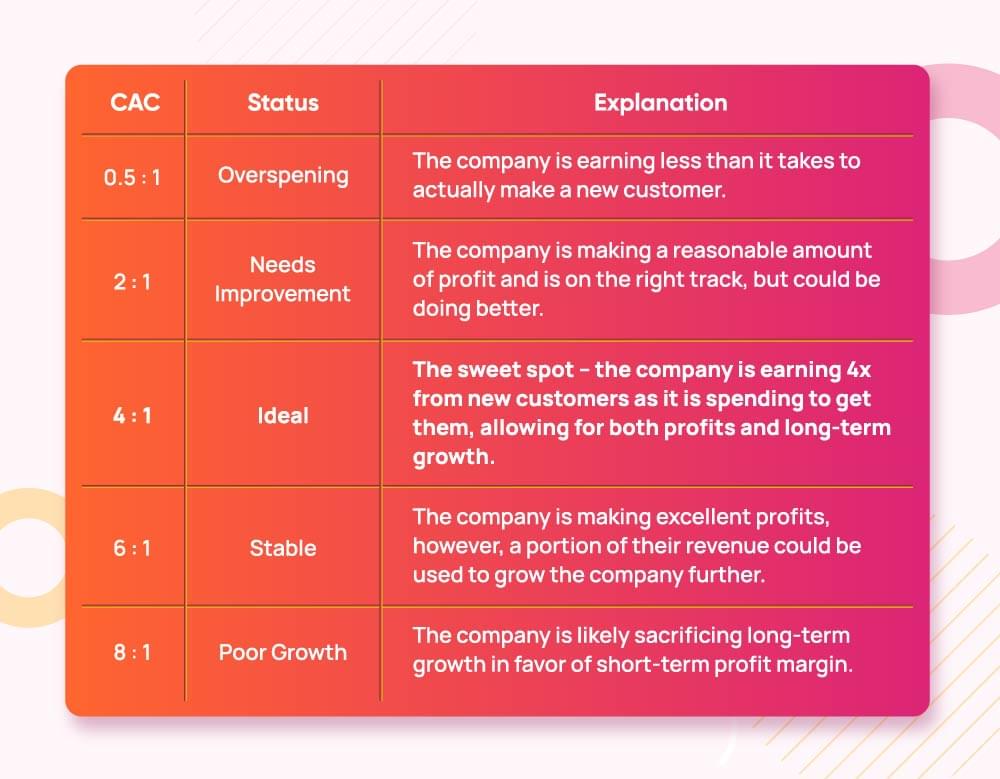

One way to identify the right CAC for your product or industry is through the LTV to CAC ratio. If your business has an LTV to CAC ratio of 3:1, be glad as it is considered reasonable progress in the SaaS industry.

For example, if you acquire a customer for $1000, you need to earn $3000 from the customer across their lifetime on the product. Anything below this, you’ll bleed money, and anything above this ratio, you have a very profitable business.

Here’s a table to help you understand LTV to CAC ratio

How to Calculate Profit per User with Average CAC

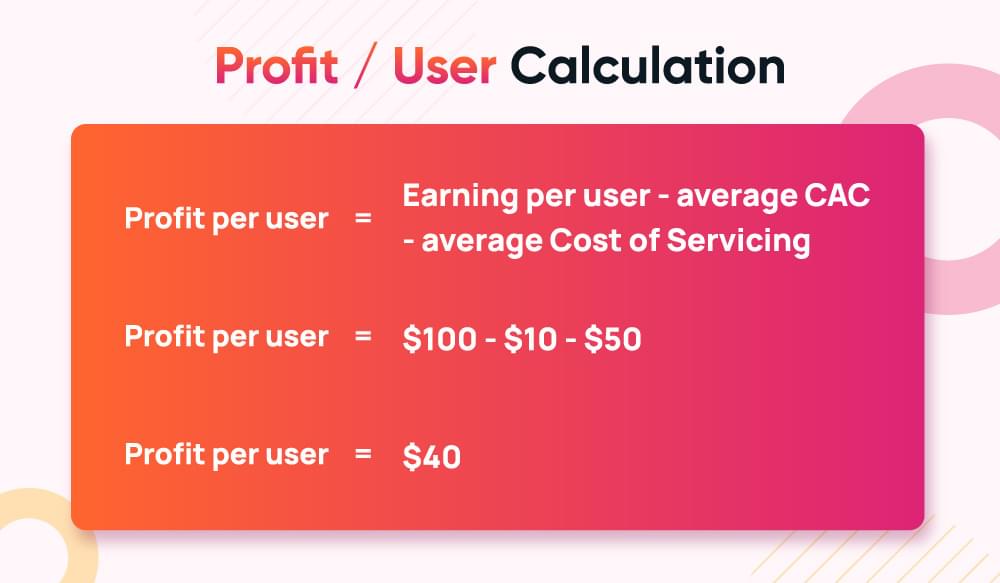

To calculate profit per user, subtract earnings per user, average CAC, and average cost of servicing.

Profit per user = Earning per user - average CAC - average Cost of Servicing

Let’s say you earn $100 on an average per user across their lifetime. Your cost of servicing (including product development and costs other than sales/marketing) is $50, so then with a $10 average CAC, you are making a profit of $40 per user.

So, any spending you are planning to do - either in terms of Cost of Acquisition or Cost of Servicing, has to make sense in terms of the profit you earn per user. This approach is especially key during the scaling stage. When your profit per user is low or negative, you’ll end up burning your cash really quickly as you are seeking growth.

Average Customer Acquisition cost Benchmarks in SaaS

On average, SaaS companies spend between $1.18 and $1.50 to acquire every dollar of new Annual Recurring Revenue (ARR), according to a study by OpenView Partners. This spending means that if your business’s ARR is $10,000 per customer, your CAC should ideally range between $11,800 and $15,000.

For early-stage SaaS companies, however, the CAC is often higher. This is due to their high initial marketing expenses, expensive brand-building activities, and product-market fit experimentation. It’s not uncommon for these businesses to see a CAC that is three to four times higher than their ARR. For new business planners, these figures reflect the upfront investments needed to establish a grip on the market.

This data, according to For Entrepreneurs, emphasizes the need to adjust your CAC expectations based on your company’s maturity and growth stage.

Early-Stage SaaS – SaaS Companies with ARR < $1M

Typically, CAC can be as high as 3 to 5 times the ARR due to higher marketing spend and lower conversion rates.

Growth-Stage SaaS – SaaS Companies with ARR between $1M – $10M

In these companies, the CAC drops to 1.5 to 3 times ARR as they start benefiting from brand recognition and better-targeted marketing efforts.

Mature SaaS Companies – SaaS companies with ARR > $10M

CAC of companies in this category stabilizes around 1 to 1.5 times ARR, and you can clearly see that they achieved it by their optimized sales and marketing processes.

But these numbers need to be more accurate because they are industry average figures and the actual numbers of your business could be way low or high based on your product or domain realities.

Related read: B2B SaaS Benchmarks

Research Questions Before You Calculate CAC in SaaS

While you are on the right track using LTV (and congratulations on knowing what it is and how to use it), there is more data required than just using LTV alone, so ask yourself these questions before you head to calculate the average CAC or even CAC for your business.

That $1000 in the question- over what period of time?

What media is currently used? What is the cost to acquire a customer by each media??

What is the current break-even cost where you recover the cost to acquire by the subscription?

These are the types of research questions needed to give an answer that applies to your business.

What are General Trends of CAC in SaaS Industry

Here are some influential trends that have significantly impacted CAC across various industries worldwide – including SaaS industry.

Spending Big on Digital Marketing

The rise of digital marketing channels has caused increase in spending on customer acquisition. This is because multiple digital marketing channels are available to businesses on a few clicks. Companies are investing more in these channels to reach a wider audience and drive conversion.

Focus on the Right Crowd – Customer Lifetime Value

As the buyers get more intelligent, many companies have also shifted their focus from short-term acquisition to long-term customer value – especially the SaaS sector prioritizescustomer retention management and lifetime value. They understand the damage churn rate can cause their business and the fact that acquiring new customers is a costly than retaining existing customers. Here are a few more links for your attention to your business details:

What is Net Revenue Retention (NRR)

What is Net Sale vs Net Revenue

Marketing with a Brain

The use of modern tools and techniques to analyze data gives you a competitive edge when it comes to marketing your company. For example, social media and email marketing can be automated with programs like Marketo and MailChimp. Google Analytics and other similar solutions help you get strong insights into your website, like website traffic, user behavior, and the customer journey. Churn management has been made easy by platforms like Churnfree, which empower you to get customer feedback, conduct churn surveys, and manage them efficiently to help you make better decisions for your business through cancel flow.

How to Stay Updated on SaaS Trends

So how can you stay up-to-date to cope up with these ever changing trends, here are a few tips:

Industry-specific reports offer a valuable glimpse into the market trends. For in-depth analyses, consider reports published by research firms like Forrester,Gartner, or Bain & Company.

Publicly traded SaaS companies often disclose their customer acquisition costs in their financial statements. These financial reports can really provide you the insight into what other businesses are doing and how they are navigating current market conditions.

If you are in a SaaS business, then SaaS industry publications can provide you an insight. Publications like SaaS Journal, SaaS Hub, or TechCrunch often cover trends and data related to CAC.

Hopefully, you have understood the customer acquisition cost in the SaaS industry. To read more about the topic with examples and details, read the blog: customer acquisition cost for SaaS.