Gross Sales Vs Net Sales in 2024

Gross sales vs Net sales has been an ongoing debate for long. Gross sales also known as revenue sales is different from Net sales.

Table of Contents

- Gross Sales Vs Net Sales

- What are Gross Sales

- What are Net Sales

- The Benefits of Net Sales

- Why are Gross Sales Essential?

- Is Net Sales the Same as Gross Revenue

- The Bottom line

Let’s quickly go through Gross sales vs Net sales main pointers.

Let’s jump right in

Gross Sales Vs Net Sales

Net sales refer to the total amounts of money a business can make from a particular product or service minus returns, allowances or discounts. Revenue sales or Gross Sales give the raw sum of money that a business makes without any deductions such as refunds etc.

Which one is better? Gross sales vs Net sales? Well it again differs, if you are looking it the bottle picture way then. If you are concerned with the overall revenue, then, unquestionably, net sales should be of more interest to you. Of course if you’re in the position of looking for broader expansion and scale, then revenue sales may well be more relevant.

Related Read: Gross vs Net Retention

Here’s a quick example: Assume a company X has $100 and company Y has $120 in gross sales. But company Y has $10 refunds and $15 in returns. While company X has only $2 in refunds. Then even though the gross sales amount of company Y was more (revenue), it still has less profit than company X as it has more money going out(net). Because the net sales of company X would be $98 while net sales of company Y would be $95.

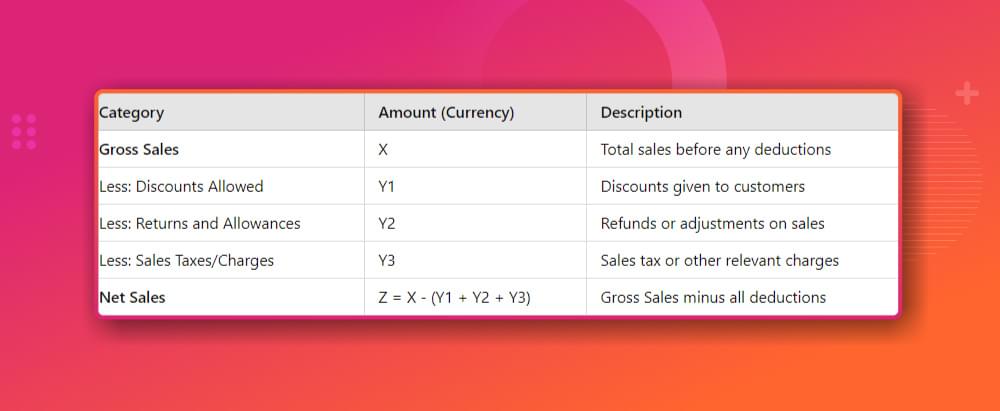

Here’s another detailed example:

This is a simple example for you to understand which metric is essential for you. Some companies with very less money going out prefer measuring gross sales because its easier to calculate. So take some time to carefully analyze about which metric about net sales vs revenue sales makes more sense for you and your company before making any decisions! It depends on your specific business and what you’re trying to achieve.

What are Gross Sales

Gross sale is the total revenue gained by the business without any deductions. You can calculate the gross sale of a company yearly to measure the earning potential of a company. Gross sale metric is used by businesses to measure their overall income through sales. They can then compare their gross sale with their competitors to analyze their market reach. Gross sales don’t add any discounts, refunds or allowances so usually the total amount is over stated than actual revenue.

Gross sales can be useful in the context of the growth and expansion strategies of the company as it identifies the raw sales power and the customers’ demand, depicting total sales without adjustments.

What are Net Sales

Net sales reflect the actual revenue a company retains after accounting for deductions like discounts, returns, and allowances. It’s the figure that really matters when assessing how much money is flowing into the business. By filtering out adjustments, net sales offer a more precise view of revenue, providing better insight into the business’s true financial health and performance. This metric is essential for evaluating profitability and making informed strategic decisions.

Net Sales is mostly used by subscription based businesses where they face a lot of unsubscriptions, retail stores and E-commerce platforms where they face a lot of refunds and offer alot of discounts.

Related Read: Is net sales the same as revenue

The Benefits of Net Sales

As a SaaS business owner, you’re always looking for ways to increase sales and grow your business. Net sales will help you:

Measures your company’s overall sales performance

Net sales can help you identify areas of your business that need improvement.

It’s a helpful metric for evaluating your marketing efforts.

Net sales can give you insight into your customer’s behavior.

It can help you track your progress over time.

Net sales can help you benchmark your performance against competitors.

It’s a valuable metric for investors.

Net sales can help you manage inventory levels.

It can help you make pricing decisions.

Net sales is a key metric for any business owner looking to increase sales and grow their company.

Why are Gross Sales Essential?

Improves your bottom line

Tracks your progress

Allows you to reinvest in your business

It helps you attract new customers

It enables you to retain existing customers

Supports business growth

It allows you to generate leads

It supports you improve customer satisfaction

It allows you to create a competitive advantage

Is Net Sales the Same as Gross Profit?

Again, these two terms stand widely apart from each other or in other words, they are not the same.

Let’s see on what grounds they differ from each other and why is it necessary for you to understand the differences to implement on your business?

Net sales is the total revenue from all sales of goods and services, minus any refunds or discounts. Gross profit is the total revenue from all sales of goods and services minus the cost of goods sold.

The primary difference between net sales and gross profit is that gross profit includes the cost of goods sold, while net sales do not. The cost of goods sold consists of the cost of raw materials, manufacturing, and shipping. So, if your gross profit is higher than your net sales, your company is making a profit after all expenses are paid.

Another difference between net sales and gross profit is that net sales can be used to calculate your company’s net retention rate. Net retention rate is the percentage of customers who stay with your company over a period of time. To calculate it, you take the number of customers at the end of a period and divide it by the number of users at the start of the period. Then, you subtract the percentage of customers who cancel their service from the percentage of customers who stay.

For instance, let’s say that you have 100 users at the beginning of a year and 90 users at the end of the year. That means that your retention rate would be 90%. But, if 10% of those customers cancel their service, then your net retention rate would be 80%.Is total revenue the same as net sales.

Is Net Sales the Same as Gross Revenue

There is a wide difference between the two.

Gross revenue is the total amount of money your business brings in from sales of goods or services. This includes all money that’s earned before any expenses are deducted.

Net sales, however, is the total amount of money brought in from sales after deducting any returns, allowances, or discounts. In other words, it’s your gross revenue minus any money refunded to customers or taken off the sale price.

So, why is it important to know the difference between gross revenue and net sales?

This is a question, why do you need to know about Gross sales vs Net sales. Well, gross revenue is a good indicator of your business’s overall health. It shows how profit your business is bringing in and can be used to compare year-over-year growth.

Net sales, however, is a better indicator of your business’s bottom line. This is because it shows how much money your business makes from sales after all expenses are considered.

Knowing both gross sales vs net sales is essential for understanding the health of your business. But if you had to choose one, net sales is the more important number to focus on. As it shows you how much profit your business is actually making from its sales.

The Bottom line

Having in-depth knowledge of the key differences can help you make the best business decision.

With the world being so fast and the technology backing up every wonderful solution, do you still need to do all the calculations manually? And would these calculations be accurate? Knowing the difference between Gross sales vs net sales will do the job for you as a business person. Let Churnfree handle the rest of the math’s for you.

Here are some more guides you might want to read onto:

Customer retention management for new and existing customers

How to win back lost customers

B2B customer journey

Churn rate vs Retention rate