How to Achieve Net Negative Churn in 2024

Net Negative Churn is the most valuable negative metric in modern business models. Let’s know the WHATs and HOWs of this much-prized indicator of SaaS business.

Negative churn is the most powerful growth engine for SaaS businesses. It points out that your existing customers find enough value in your service to increase their spending over time, which offsets the losses from those who leave. This dynamic is necessary for long-term sustainability.

Keep reading, and you’ll learn what net negative churn is, the net negative churn rate formula, and how to achieve it.

What is Net Negative Churn

Net negative churn means your overall business revenue increases during a specific period despite losing customers. It occurs when you earn more from your existing customers than you lose in service cancellation or downgrade from customer churn.

Can You Have a Negative Churn Rate

Of course – YES.

Net negative churn, or negative churn rate, happens when revenue gained from existing customers through expansion strategies like upgrades and cross-selling is higher than the revenue lost due to customer churn.

For example, you may lose some customers that makeup 5% of your annual revenue. However, your existing customers purchased additional services valued at 10% of annual revenue. So, despite the fact that you lost customers, you came out in the green with 5% revenue growth.

Why Should You Achieve Net Negative Churn and How It Relates to Revenue Growth

Customer churn is a must in every business, and the negative churn rate of a business clearly speaks to the integrity of the organization among its customers.

Net negative churn is mainly associated with SaaS and subscription-based business models, and this SaaS metric solely focuses on your existing customers. Seeing a negative churn rate in your revenue books indicates that your company is growing its revenue from its current customer base despite losing some customers. It’s also a powerful sign that your business is successfully enhancing its value over time and can retain valuable customers. It also indicates the following:

- Steady Revenue Growth: Shows that the extra money from current customers is more than what’s lost from those who leave, keeping your revenue growing consistently.

- Loyal Customers: This indicates that customers love your product enough to spend more, staying around longer and providing a stable base.

- Cost-Effective: It’s cheaper to keep and upsell to existing customers than to find new ones, giving you a better bang for your buck.

- Competitive Edge: Helps you maintain revenue growth even if new customer sign-ups slow down, keeping your business financially healthy.

- Financial Stability: This leads to better financial planning and stability, so you’re not always scrambling to replace the lost revenue with new customers.

How to Calculate Net Negative Churn

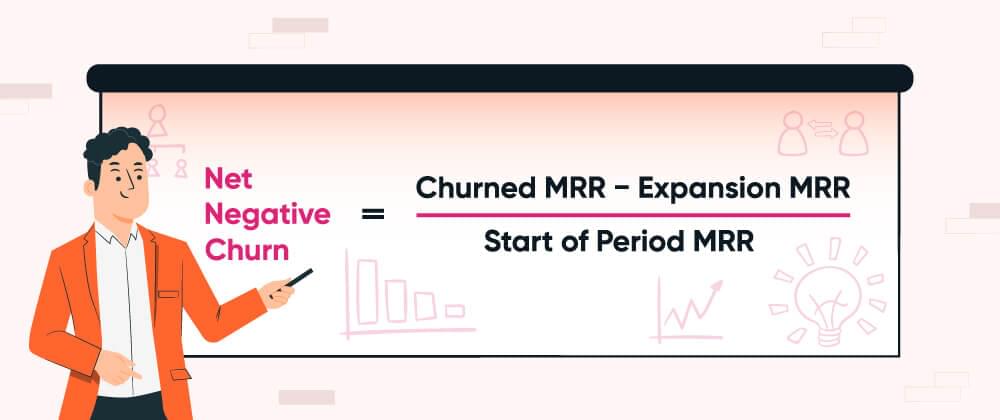

Below is the Net Negative Churn Formula:

- Churned MRR is the total monthly recurring revenue (MRR) lost from churned customers.

- Expansion MRR is the total monthly recurring revenue (MRR) gained from existing customers through upsells, cross-sells, and upgrades.

- Start of Period MRR is the total monthly recurring revenue (MRR) at the beginning of the period.

How to Apply the Negative Churn Rate Formula

Example Calculation:

- Start of Period MRR: $100,000

- Churned MRR: $5,000

- Expansion MRR: $10,000

Net Churn Rate: ($5,000 - $10,000) / $100,000 = -5%

5 Best Strategies to Help You Achieve Net Negative Churn Rate

To help you keep your existing customers happy and take advantage of the benefits of negative churn, we will discuss the five most effective strategies to increase customer value, reduce customer churn, and speed up business growth.

1. Cross-Selling

Cross-selling is all about encouraging your customers to buy additional products or services that complement their existing purchases.

Cross-selling provides extra value to your clients. The best cross-sell offers are not only related to the initial purchase but also come at a more attractive price. You’ve probably seen this in action with consumer advertising.

Imagine you’re shopping online for a new coffee maker. As you’re about to check out, the site suggests you add a pack of specialty coffee beans to go with it. You skip the offer for now. Over the next few weeks, you start getting emails from the store offering discounted coffee beans. Since you’re enjoying your new coffee maker and the beans are cheaper, you’re more tempted to buy them. The store knows you love your coffee maker and figures you might want to enhance your coffee experience with premium beans, so they keep reminding you about this related product.

This cross-selling approach works just as well in the B2B world. For instance, if a client has purchased a software package, you could offer them additional modules or services that complement their current setup. By presenting these add-ons at a lower price point, you make it easier for them to say yes, adding more value to their original purchase.

So, when you’re looking to boost your customer value, think about what additional products or services you can offer that would make their experience even better. Your clients will appreciate the extra value, and you’ll see increased growth.

2. Up-Selling

Upselling or upgrade strategies involve offering customers a more expensive or upgraded version of a product they already own.

For instance, if a client has a subscription to your basic software package, you could offer them a premium version with advanced features and benefits. Highlight how these upgrades will enhance their experience, save time, or improve productivity. This added value makes it easier for them to see the benefit of spending more on a product they already enjoy.

So, when you’re looking to boost your customer value, consider how you can entice them with an improved version of what they already love. Your clients will appreciate the enhanced experience, and you’ll see increased revenue growth.

3. Seat Expansion

Seat expansion is when you let your customers add more users. Seat expansion encourages additional purchases within the product your customer already owns. This model is standard in the software industry. If you charge a fee per product administrator or software user, seat expansion involves encouraging customers to buy more licenses for additional people who need access.

For example, imagine you’ve purchased access for three users, but then your team grows, and you need a fourth. That’s seat expansion.

Companies using this type of upselling strategy often add features that appeal to a broader range of users. For instance, if you sell financial software for businesses, you could add features that help HR manage payroll and employee information, encouraging more users to sign up.

When promoting seat expansion, clearly explain the benefits of adding additional users. How will having more seats at the table benefit your customers? Highlight how the extra users can improve productivity, streamline processes, or enhance collaboration within their team. Your clients will appreciate the added functionality and efficiency.

4. Increasing CHI (Customer Happiness Index)

Invest in a strong customer success team. Customers who fully utilize and benefit from your product are more likely to upgrade, see its value, and stay loyal. This leads to achieving a negative churn rate and reduced customer churn.

To encourage customer engagement, you can start by consistently and meaningfully communicating. This could involve personalized email campaigns and valuable content that addresses customers’ needs and interests.

Investing in a strong customer success team can significantly enhance customer satisfaction. These teams ensure that customers fully utilize your product and can help troubleshoot any issues.

For instance, imagine you run a project management software company. Your customer success team could proactively contact clients to offer training sessions, helping them discover advanced features that streamline their workflows. When customers see the tangible benefits of your product, they’re more likely to stay loyal and consider upgrades.

Offering excellent customer support is also crucial. Quick and effective problem resolution can turn potentially harmful experiences into positive ones. For example, if a customer encounters a bug in your software, your support team’s prompt and helpful response can reinforce their trust in your company.

Additionally, gathering and acting on customer feedback shows that you value their input and are committed to improving their experience. Implementing a customer loyalty program can further boost engagement by rewarding repeat business and long-term loyalty. Think of it like this: a customer who consistently uses your software might earn points toward free months of service or exclusive access to beta features – Voila!

5. Leveraging Customer Data

Use data insights to personalize offers and services.

Specially designed recommendations make upselling and cross-selling efforts much more effective and natural.

Start by collecting data on your customers’ behavior, preferences, and usage patterns. This information can help you understand what they value most about your product. For instance, if you notice that a customer frequently uses a particular feature of your software, you can recommend an upgrade or an add-on that enhances that feature.

Imagine you run an e-commerce platform. By analyzing purchase history and browsing behavior, you can suggest complementary products that align with your customers’ interests. For example, if a customer frequently buys running gear, you could recommend new running shoes or fitness trackers tailored to their preferences.

Using customer data to segment your audience can also improve your marketing campaigns. Tailored messaging and emails can get higher customer engagement.

Leveraging customer data also helps identify at-risk / possible churn customers. By monitoring usage patterns and engagement levels, you can proactively reach out to these customers with personalized offers or support to re-engage them.

This is where churn prediction software like Churnfree comes in handy. Churnfree offers a wide range of solutions to help you study and analyze customer data effectively. Their platform provides insights into customer behavior, helping you create targeted retention strategies and personalized marketing campaigns.

Once you have your customer data and tools like Churnfree, you can create more relevant and appealing offers, enhance customer satisfaction, and reduce churn. Personalized interactions show your customers that you understand their needs and are committed to providing the best possible experience.

What is the Difference Between Net Negative (Revenue) Churn and Net Negative Churn Rate?

There is essentially no difference between net negative (Revenue) churn and net negative churn rate, and both terms can be used interchangeably. They both share the same formula. Here, note that net negative churn is also called net negative Revenue churn.

However, when detailed, negative revenue churn and negative net churn rate describe slightly different customer and revenue dynamics in SaaS and subscription-based business models.

Here’s how they differ:

- Net Negative Revenue Churn emphasizes specifically the revenue aspect. It focuses on the net change in revenue due to churn and expansion. Meanwhile, net negative churn rate is a broader term used to describe the overall churn from customers and revenue.

- Net Negative Revenue Churn is used in financial and revenue reporting to highlight how revenue from existing customers can balance losses from churn. Meanwhile, the Net Negative Churn Rate includes discussions about customer retention strategies, lifetime value, and overall business health.

Conclusion

This article has tried to help you understand net negative churn, why it is important within the SaaS industry, how to approach negative churn rate strategically by reducing churn and increasing revenue, and how to calculate it.

Hopefully, we understand now that net negative churn improves a business’s financial health, develops a system for loyal customers, and helps the business be more innovative.

If you want to learn more on SaaS churn rate, B2B SaaS Benchmarks, customer retention strategy, and winback campaign strategies, then visit the Churnfree Blog for detailed insights.

FAQs

What does net churn mean?

Net churn, or Net MRR Churn Rate, represents the overall percentage of monthly recurring revenue (MRR) that is lost from existing subscriptions or customers during a specific period. It considers the MRR gained from expansions and upgrades among the remaining customers.

What is the standard formula for calculating the churn rate?

It is calculated by:

Churn rate = (Lost Customers ÷ Total Customers at the Start of the Time Period) x 100

For instance, if a business starts the month with 250 customers and loses 10 by the end of the month, you would calculate ten divided by 250, resulting in a churn rate of 4%.

What is considered an acceptable net churn rate?

An acceptable net churn rate typically falls within 5 to 7% annually.

What is Net Negative Revenue Churn?

Net negative revenue churn focuses on revenue gained from existing customers and does not focus on revenue generated from new customers.

How to Check Negative Revenue Churn?

The Net Negative Revenue churn formula is similar to the calculation of negative net churn. Here is how to check negative revenue churn.

Net Negative Revenue Churn Rate = (Revenue Lost from Churn - Revenue Gained from Expansions) / Total Revenue at the Beginning of the Period

What is Net Revenue Retention?

Net revenue retention (NRR) measures the percentage of revenue retained from existing customers over a specific period, including upgrades, downgrades, and churn. It provides a broader view of revenue growth from existing customers while considering positive and negative customer spending changes.

NRR = (Starting MRR + Expansion MRR - Churned MRR - Contraction MRR) × 100 / Starting MRR