Churn Rate: A Complete Guide to Customer Churn 2024

We all like to believe that our customers will stay loyal to us, but in reality, All Things Must Pass. Even the most successful companies face shifts in customer preferences, types of competition, and market conditions.

Table Of Contents

- What is Customer Churn?

- What is Churn Rate?

- How to Calculate Churn Rate

- What is Monthly Churn Rate

- What is Annual Churn Rate

- What is Seasonal Churn Rate

- Churn Rate and Growth Rate

- How to Instantly Reduce Churn Rate?

- What is a Good Churn Rate

- High Churn Rate or Churn in Business

- Why Calculate Churn Rate

- Why not to Chase Churn Rate Only

- Types of Customer Churn

- Industry Examples of Churn Rate

- How to Track Churn Rate

Doing business aims to create revenue and increase monthly recurring revenue (MRR). This widely depends upon the number of customers acquired; especially since your active customers are the ones creating revenue. But what about those who leave us – our ex-customers

✔️ Your ex-customers are your churned customers.

This blog is related to churn rate and we will help you understand everything you need to know about what the customer churn rate in a business is and what are its industry benchmarks. However, if you want to reduce customer churn or are looking for benchmarks for churn rates in SAAS business only, then click here.

What is Customer Churn?

Customer Churn is when a customer stops using your product or service over a particular time—also called customer attrition, customer turnover, or customer defection.

What is Churn Rate?

Customer churn rate is the percentage of your users who stop using your product or services during a specific time.

✔️ It is the rate at which your company loses its customers.

✔️ Churn rate depicts the ratio of customers leaving a business to those staying with the business.

✔️ Reducing churn means retaining your customers longer.

✔️ Reduced churn rate means an increased revenue rate and increased growth rate.

✔️ Churn rate highlights the shortcomings and areas for improvement of your business.

✔️ Churn rate is also called customer attrition rate, customer turnover rate, or customer defection rate.

✔️ It is possible to achieve a net negative churn.

Operating a business successfully sounds like spending more to acquire new customers, but experienced businessmen always strive to keep their existing customers. It is no secret that acquiring new customers costs way more than retaining your existing customer base.

According to a study published in the Journal of Consumer Research, word of mouth (WOM) was seven times more effective than print advertising in influencing consumers to switch brands. This means that over time, your existing customers become your brand ambassadors.

You can create strategies to keep customers and avoid losses by analyzing the churn rate.

Churn rate is an essential calculation for companies, particularly for subscription-based business models, because subscriber churn has a direct impact on revenue growth.

Understanding your churn rate by comparing your data over time and/or comparing it with industry standards can help you assess your performance.

How to Calculate Churn Rate

Churn rate can be calculated in different ways but two methods are primary. We will try to provide you with a clear understanding of the methods and formulas involved in both calculations.

1. Customer Count Method or Customer Churn Rate

As the name suggests, this method of churn rate calculation involves counting the number of customers lost in a specific time. Please note that a customer is counted as churn the next day - the day after their service expiry or cancellation. For example, if a subscription is canceled on Sunday, it will be counted as churn on Monday and not the same day.

Here is the formula and an example:

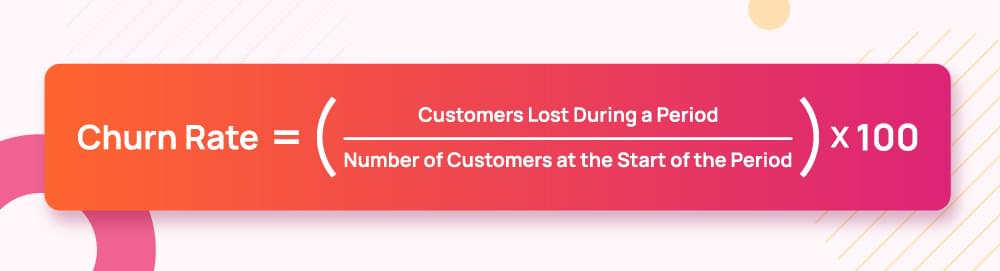

Churn Rate= ( Customers Lost During a Period / Number of Customers at the Start of the Period ) ×100

If a company had 500 customers at the start of a month and lost 50 customers that month, the churn calculation will be:

( 500 / 50 ) x 100 = 10%

2. Revenue Count Method or Revenue Churn Rate

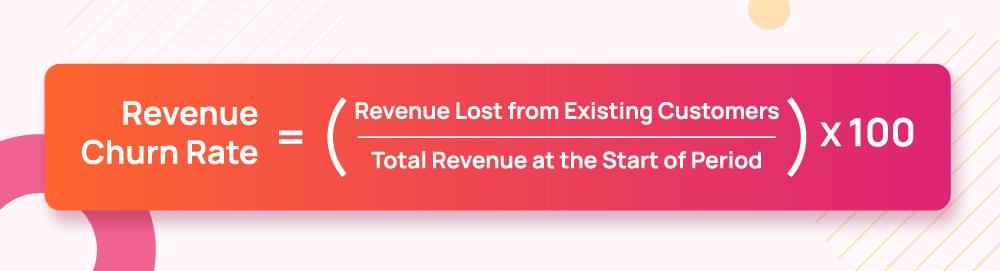

Revenue churn rate is the percentage of lost revenue from existing customers over a specific time.

Customer churn counts the number of customers lost, whereas revenue churn considers the actual amount of revenue lost due to customer cancellations, downgrades, or less spending. To know more about revenue churn vs. churn rate, click here.

Here’s the revenue churn rate formula:

Revenue Churn Rate = (Revenue lost from Existing customers / Total revenue at the Start of Period) x 100

Revenue churn captures two types of losses:

Downgrade Churn: This is when a customer switches to a lower-priced product plan.

Cancellation Churn This is when customers stop using a service entirely.

A low revenue churn rate suggests that the company is effectively retaining its revenues whereas a high revenue rate suggests that the company needs better customer retention strategies or needs a better customer product-fit.

Depending on the business model, the churn rate can be calculated on a monthly or yearly basis. However, you need to have a clear understanding of what you are calculating.

What is Monthly Churn Rate

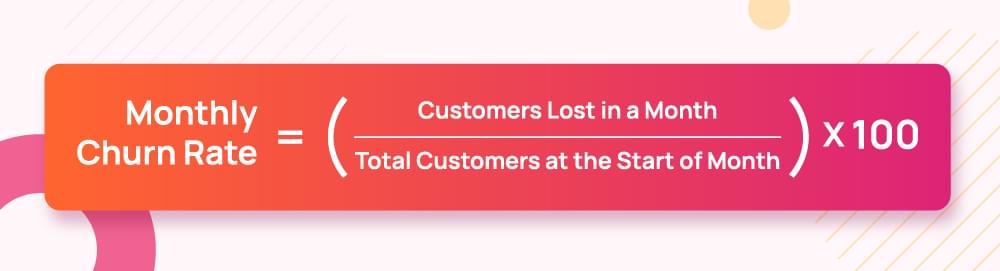

Monthly churn rate is the percentage of users lost during a month. The churn rate of a month is the monthly churn rate.

To calculate the monthly churn rate, the number of customers you lose in a month is divided by the total number of customers you had at the beginning of the month. The result is multiplied by 100 to get the percentage.

Monthly Churn Rate = (Customers Lost in a Month ÷ Total Customers at the Start of Month) x 100

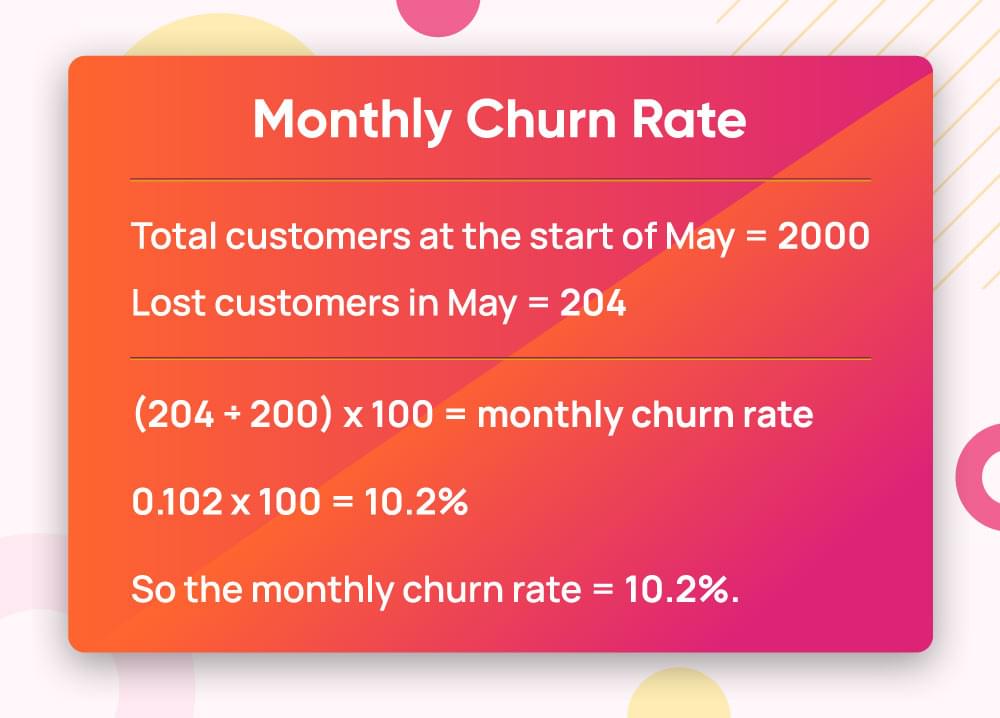

Here’s an example to calculate the churn rate for a company ABC for May.

What is Annual Churn Rate

Annual churn rate is the percentage of users lost during 12 months. Churn rate of a year is the annual churn rate.

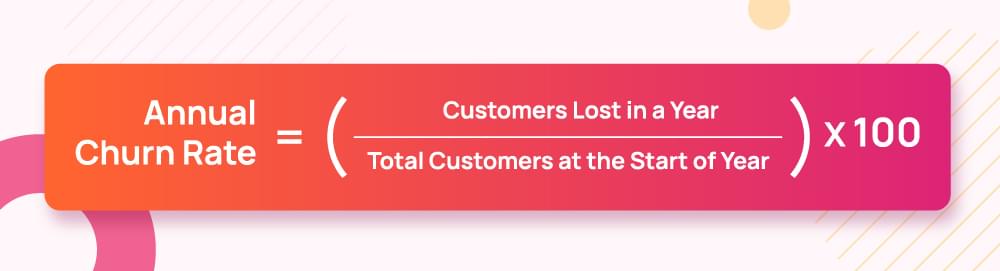

To calculate the annual churn rate, the number of customers you lost in a year is divided by the total number of customers you had at the start of the year. The result is then multiplied by 100 to get the percentage.

Annual Churn Rate = (Customers Lost in a Year ÷ Total Customers at the Start of Year) x 100

Here’s an example to calculate the churn rate for a company ABC for the year 2023.

A lower churn rate indicates better customer retention, whereas a higher churn rate indicates that the company either needs to improve its product or its customer relationships.

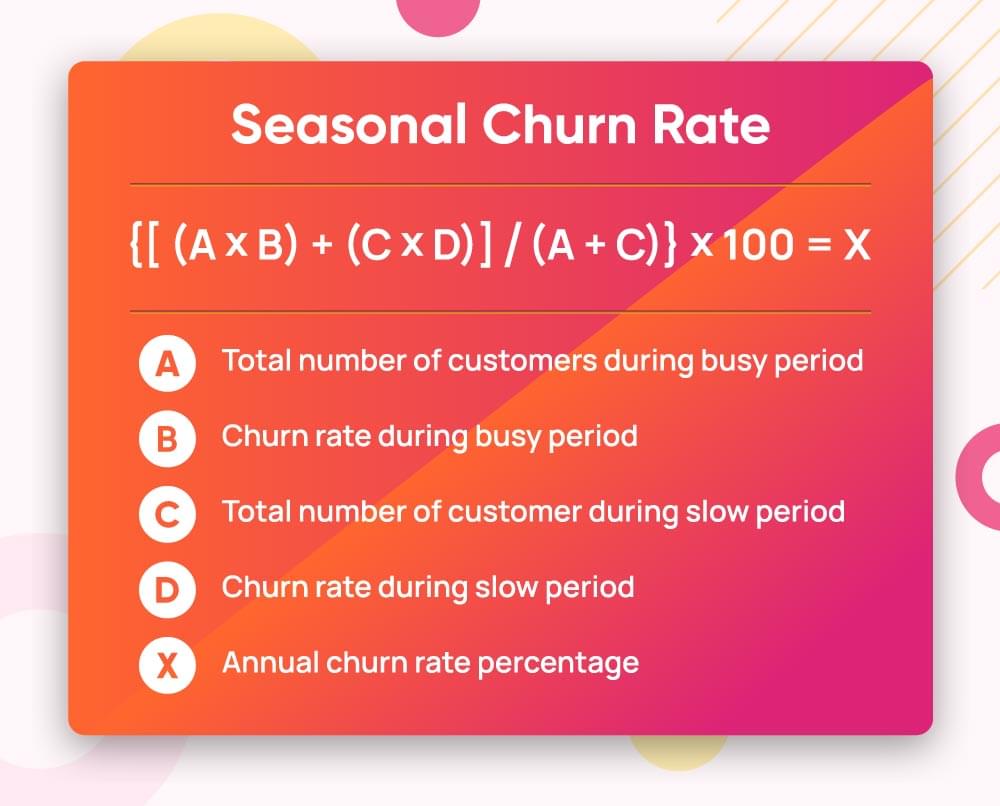

What is Seasonal Churn Rate

The term seasonal churn rate describes the variation in customer churn that happens at specific times of the year. These fluctuations are sometimes caused by business cycles, holidays, or other factors like weather or academic schedules.

You must have noticed that more people fly to national or international destinations during holidays which makes the churn rate of the aviation industry decrease particularly during the holiday season and therefore they happily offer discounts and promotions.

On the other hand websites with educational content may find high seasonal churn rates during holidays when schools and other academics are closed.

The formula to calculate seasonal churn is somewhat complex however, it will provide an accurate churn rate.

Churn Rate and Growth Rate

Your business’s churn rate focuses on the percentage of customers leaving, whereas the growth rate highlights the percentage of your customer acquisition. These two crucial calculations of your business are interconnected because a high growth rate can kill a high churn rate and vice versa. The growth rate works to provide business stability, but if you do not deal with your customer churn and just concentrate on growth, you risk stagnation or revenue loss.

Now consider this, if your company adds 50 new customers in a month but 25 of its existing customers churn, it means its growth is only half the good. Therefore, balancing growth with churn is important for long-term business stability.

How to Instantly Reduce Churn Rate?

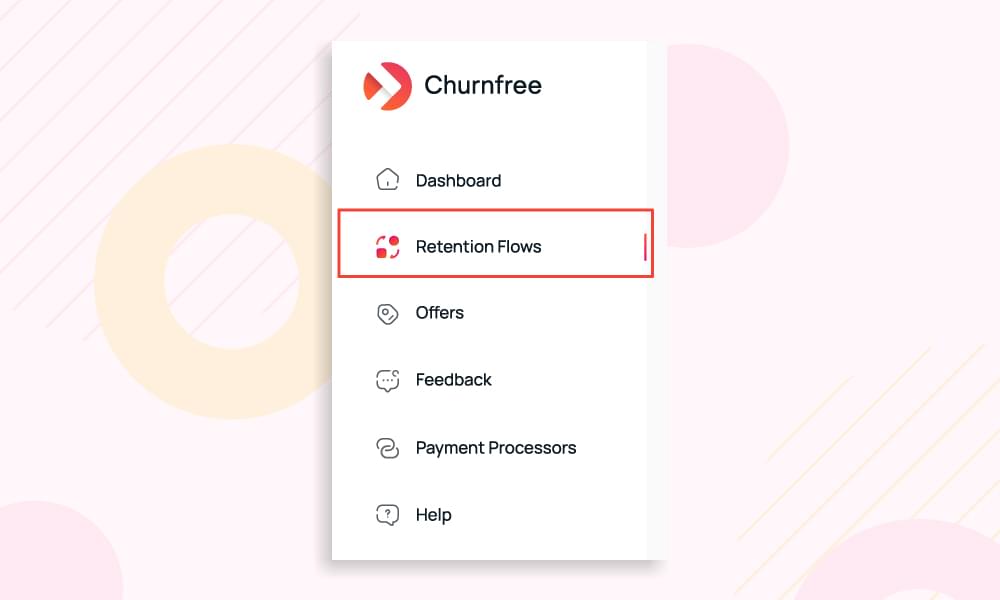

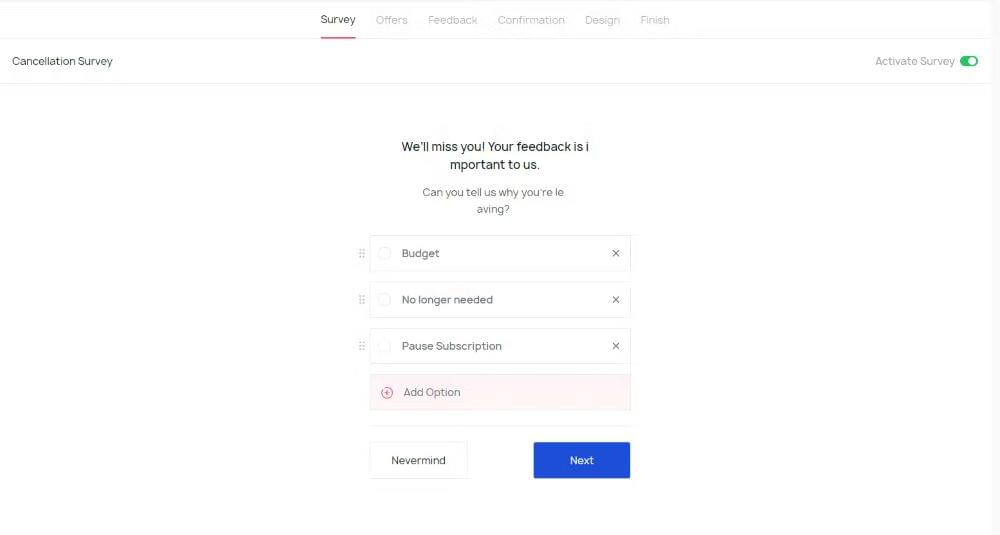

While there are many ways to reduce churn, the smartest and fastest way is integrating a cancel flow into your software.

Cancel flow is part of your business’s customer retention process and you make customers go through it before they end a service or subscription.

You can answer customers’ complaints and then provide customized solutions, or even offer them alternative service plans if a cancellation flow is integrated into your business software. Another way is to offer them to pause their subscription instead of canceling it. Cancel flows not only help save customer relationships but also provide insight into the reasons for these cancellations.

Sign Up to Churnfree for free to get your cancel flow ready.

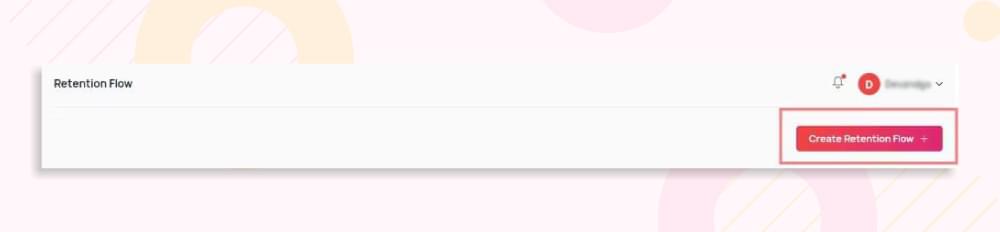

Create your first retention flow here:

Create your customized offers including pause subscription to your flow.

To setup and integrate cancel flow to your tool. Follow this guide.

Churnfree provides you with an up-to-date solution to manage the cancellation process. With the help of this modern platform, you can create a personalized cancellation flow for different cohorts of users that provides timely intervention in churn process. It provides options to the users that can help you convert cancellations into retention possibilities.

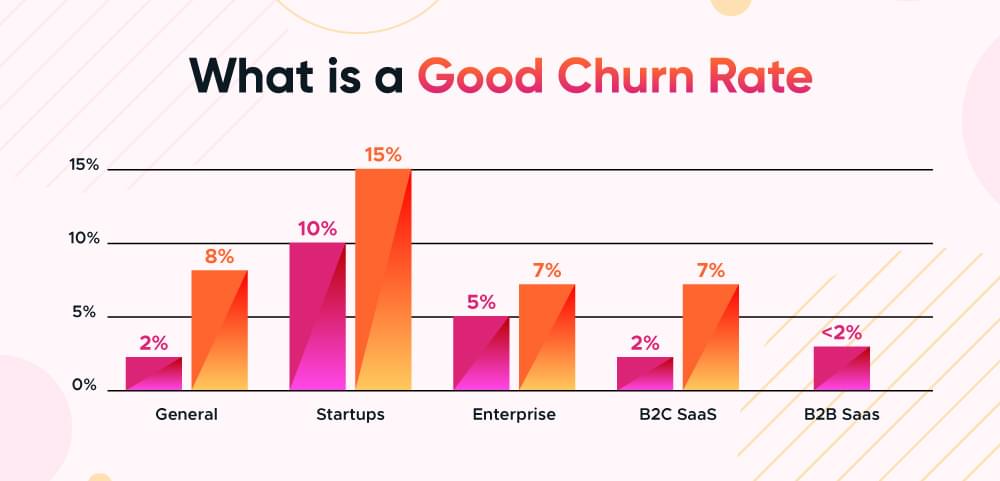

What is a Good Churn Rate

A good churn rate varies by industry. But here are some industry benchmarks for different business modes to give you an idea.

In general, most businesses see a churn rate of 2%–8%.

For Small Businesses and early startups, a churn rate between 10% and 15% is considered normal since their business and product are in the development phase.

For more established businesses, the acceptable churn rate drops to around 5%–7% annually.

For B2C SaaS businesses, the good churn rate is anywhere from 2% to 7%. However, the lower the better, or it can slow down your MRR.

For B2B SaaS businesses, the bar is even higher; ideally, their churn rate should be below 2%. This is because of their long-term contracts and customer relationships are more common in space.

The graph represent the churn rate range across various industries.

Related Read: What is a good churn rate for SaaS

High Churn Rate or Churn in Business

A high churn rate indicates a red flag that your customers are dissatisfied and the business is facing churn. High churn suffocates growth and makes it difficult for companies to balance or even maintain their existing customer base. This could be due to many factors, such as:

Poor customer service

Product quality issues

Overpricing

High competition

When facing high churn, you need to take immediate action to improve customer experience, support, and product development. Implementing customer retention management strategies can also help you a great deal. Similarly, processes like customer lifetime value (CLV) should also be in place to improve long-term business sustainability.

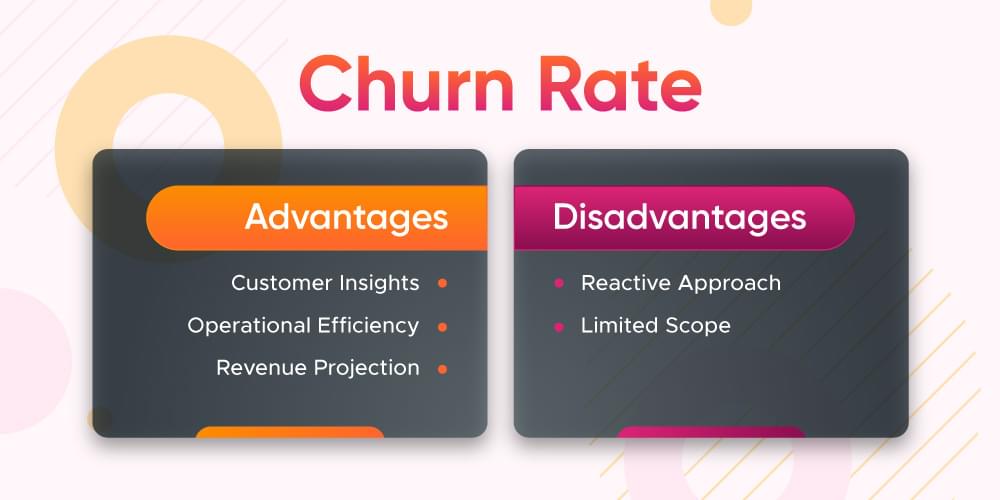

Why Calculate Churn Rate

You can always help your business by identifying the reasons for customer attrition and adjusting customers’ services to address their pain areas by keeping an eye on customer churn rate. Here are some of the benefits of churn rate:

Understand Customer Behaviour for Better Decision Making

Monitoring the churn rate can help understand why customers are leaving your product. This approach will enable you to understand customer behaviour and their satisfaction level with your business so that you can make targeted improvements.

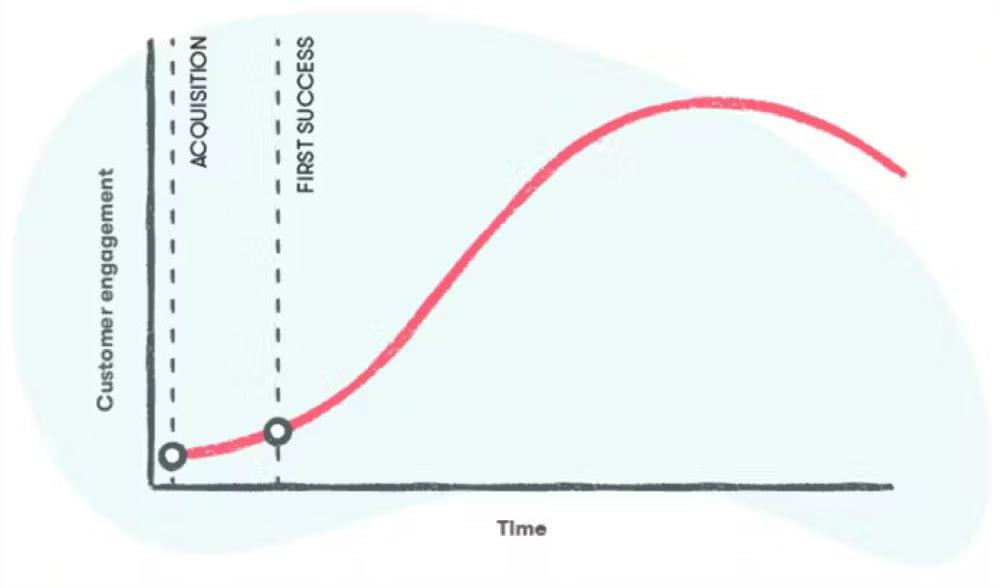

Dropbox, a well-known SaaS company, realized customer churn at the time of onboarding. Dropbox reported a churn rate decrease after they improved their customer onboarding experience in 2020.

Improving onboarding experience is just one example, to improve churn rate, you need to look at all areas of your business that impact customer satisfaction and their complaints, directly or indirectly.

Run Operations Efficiently and Improve Productivity:

The churn rate helps you identify the areas of inefficiency in your business operations and allows your business to refine them to meet customer needs. This way your business operation and strategies will be more customer centric and the retention efforts will be more fruitful.

Just like Netflix, when they optimized their content delivery operations once they identified that their customers were leaving due to different content preferences. Netflix started creating its original shows like “Stranger Things” which reduced their churn significantly. Similarly, McKinsey reported 15%-25% reduction in churn when they improved their processes through data analysis.

Predict Future Revenue and Expenses:

The churn rate can give you a clear understanding of where to put your money and where not to in the future. It can tell you which areas of your business need revenue for improvement, for example, product development or the customer service department. This can help you improve your financial models and growth rate.

In first quarter of 2022, Spotify, a subscription-based service, saw millions of dollars increment in yearly revenue when their churn rate dropped by 4% only.

Below are some more reasons to help understand why you should calculate churn rate of your business, it can help you to

- Understand your competitors in market

- Develop your product as per customer need

- Implement strategies for customer retention & customer lifetime value

- Win investors confidence

- Improve marketing strategies

Why not to Chase Churn Rate Only

There are two main reasons why you should not always chase to improve churn rate only.

Since the task of improving churn can be daunting, sometimes focusing too heavily on churn can result in a reactive approach where you and the business are constantly firefighting to make customer retention efforts work rather than innovating new solutions so that you could avoid this firefight.

Secondly, churn rate alone does not explain why customers are leaving, so it needs to be complemented with qualitative insights such as your customer feedback, net sales, gross sales, net revenue retention figure etc.

Types of Customer Churn

Customer churn is calculated on the customer level. Most of the organizations do not consider the churn at the subscription level. Here’s a brief look at different types of customer churn.

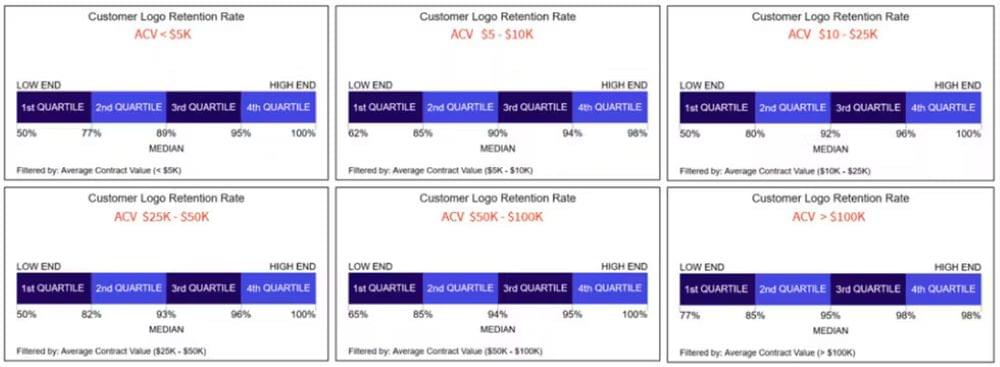

Logo Churn:

Logo churn is the other name of customer churn on a business level. It is the number of customers who churned during a specific time.

Logos of user companies are often tracked, and when a customer churns, their company logo is no longer part of your company’s portfolio.

SaaS companies should keep their Logo churn rate below 8% and keep their monthly rate of customer churn around 3%. The ideal annual median Logo churn for SaaS companies is 14%.

Voluntary Churn:

Voluntary Churn occurs when a customer actively decides to leave your business due to dissatisfaction.

Other than bad customer experience or poor product issues, this unhappiness could be due to better options available in the market or just because the customer’s personal demands have changed.

Voluntary Churn clearly reflects the customer’s experience of your product. So, you must listen to what the customer is saying and follow the feedback, take required actions, and get back in touch with the customer to gauge their satisfaction level.

Involuntary Churn:

Involuntary churn occurs when the customer actually does not want to quit your services but due to external factors, they make such an explicit decision to leave.

These external factors may include failed payments, card expiry, card frauds, and recurring charges not updated timely etc.

For SaaS companies, it is a good idea to keep an eye on customer’s credit card expiry date and inform them timely. Send them emails pre and post-dunning to avoid involuntary churn. Similarly, sometimes locking them out of the app might be a good idea to prevent further charges but this approach should be followed very carefully as it can bounce back.

Contractual & Non-Contractual Churn:

In contractual businesses like telecom services, churn is clear when a customer ends their services. It is wise to get in touch with customer well in time to inform them of their contract duration, take their feedback, and follow through so that contract renewal is smooth and you avoid contractual churn.

In non-contractual businesses like retail, there is no formal contract or cancellation process, so calculating the churn is a little trickier when you are unclear if a customer has really stopped buying from you or not.

Product Churn:

This type of churn happens when customers stop using a specific product, even when they continue using other services offered by your company.

Product churn could be due to product dissatisfaction or change in customer’s preferences or simply due to high inflation rates.

Revenue Churn:

This type looks at the revenue lost due to any other type of churn i.e. customer churn or downgrades etc. Revenue churn is particularly relevant to subscription-based businesses where the customer may remain but reduce their spending.

Employee Churn:

Employee churn is the type of churn that is an internal business matter and does not involve the use of your product or services. It focuses on employees leaving your company, which affects HR and talent retention strategies if in place in your company.

Industry Examples of Churn Rate

Different business models follow different churn rate benchmarks. Here are a few examples to understand how customer churn impacts businesses and their revenues.

Retail Churn

Loss of repeat customers who no longer engage with a store for purchasing is retail churn.

Churn rate benchmark of retail industry being a B2C business model is between 2%-7%. If you are in retail business, you would know that customers get to interact more directly with the business and therefore, it is closely related to customer loyalty and satisfaction plans. Starbucks, for example, gets over 50% of its sales from repeat customers, in the US only. They still introduced a rewards program in 2020 as a part of their loyalty strategies and as a result saw 15% reduction in churn.

Logistics Churn

Churn in logistics business mode would mean customers (individuals or businesses) are either switching to other logistics providers or are reducing their services.

There can be multiple reasons for this churn, for example, cost or performance issues of your business or customer’s lesser need to use logistics services etc. Your Logistics business, being a B2B and B2C business, needs to calculate churn following the industry benchmarks which is 40%.

Notice how DHL takeaways and revenue details show business growth by innovating new ideas to improve customer satisfaction ratio, and obviously reducing churn.

SaaS Churn

The median churn rate benchmark for SaaS business models is around 14%. This subscription based business model relies heavily on their churn rate. SaaS companies must aim to keep their churn rate below 14% at all cost. ProfitWell is a good example of this struggle. Their case-study reveals their efforts to increase their revenue and decrease their subscription churn rate.

Related Read: B2B SaaS Benchmarks

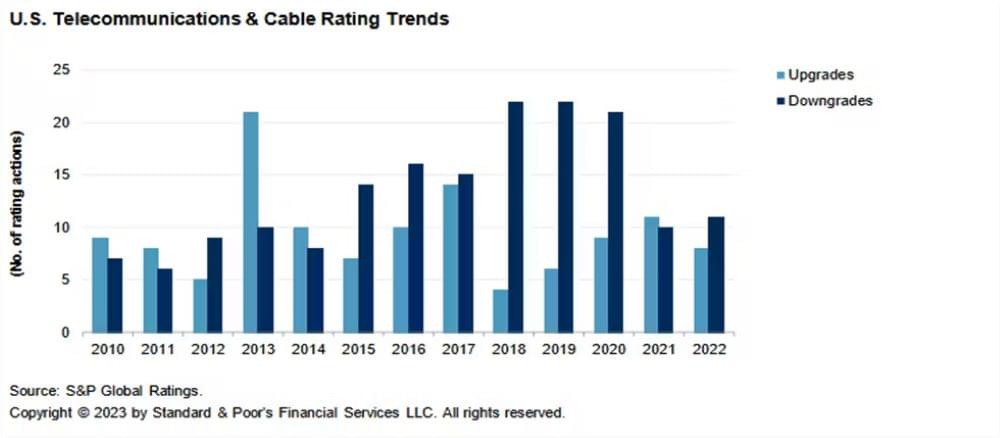

Telecommunication Churn

Churn in telecommunication business is frequent due to extremely competitive market pricing and service dissatisfaction. They cannot afford to have churn rate above 20% annually.

However, when a leading telecom in New Zealand aimed to become 100% customer centric organization, they saw ten times faster market and 30 point increase in customer and employee satisfaction ratings.

How to Track Churn Rate

If you have read till now, you must have a clear idea how you can calculate churn rate and why it is important to reduce churn. To keep a track of churn in your business, you need to implement a tracking system. Consider these steps in implementing this tracking mechanism:

Define the time period: understand why and what time period you want to select to calculate the churn rate for. This can be hourly, daily, weekly, monthly or annually report, depending on your requirement.

What is your churn: choose to define churn in your business. It could be as per industry standards or different as per your requirement. For example you can choose to calculate revenue churn, customer churn, or seasonal churn.

Use relevant tools: services like Churnfree can help you gather customer feedback and effectively implement cancel flow strategy to prevent high churn rate.

Analyze and adjust: analyze the data you have received and make changes when and where necessary – repeat the tracking process.

Repeating these steps will provide you enough data to make right decisions for your business and will help build customer-centric mind set across the board.

Wrap-Up

This blog explains every detail of churn rate and customer churn rate. Learn more about how to reduce customer churn and tips on how to win back lost customers on Churnfree blog.