What Is Customer Churn Analysis and Why Does It Matter

Worried about losing a lot of customers? Learn all about customer churn analysis to see how it can help you maintain or boost your revenue.

Imagine this: you are running a highly successful business, celebrating new customer acquisitions, and then you notice that your monthly revenue is not growing as much as expected, despite getting new sign-ups.

Well, the culprit in such a situation is high customer churn, which means that customers are leaving your business faster than you can bring new ones.

Such a scenario plays out in boardrooms across industries all the time. All of the businesses are focused on customer acquisition, but many overlook the customer churn rate that is often killing their revenue.

This points to the fact that customer churn analysis is much more than just another business buzzword. It is your revenue guardian and a solid roadmap to sustainable growth.

Whether you’re running a subscription-based SaaS platform or operating in the retail industry, learning customer churn analysis techniques can be the difference between thriving and surviving.

Table of Contents

- What is Customer Churn Analysis?

- Types of Customer Churn

- Why Customer Churn Analysis Matters?

- Methods of Churn Analysis

- Churn Forecasting Techniques

- How to Perform Customer Churn Analysis: A Step-by-Step Guide

- Common Challenges of Churn Analysis (+ Solutions)

- Taking Action: Your Next Steps

What is Customer Churn Analysis?

At its core, customer churn analysis is your toolkit to understand why customers are leaving your business. It is more advanced than simply counting how many customers walked away in a month.

Instead, churn analysis is a comprehensive investigation that answers four main questions:

- Which customers are leaving? Not all customer cancellations are equal. You should know if you are losing high-value enterprise clients or budget-conscious small businesses. Understanding the profile of churning customers reveals patterns you can utilize to retain them.

- Why are they leaving? A customer can churn due to many reasons, such as poor customer service, Pricing issues, or feature gaps. The “why” behind customer departures acts as a roadmap for business improvement.

- Which customers are likely to churn next? Identifying at-risk customers before they cancel can help you intervene with targeted retention strategies.

- What can you do to reduce churn? Once you have the insights from the first three questions, you can develop data-driven strategies that address root causes to prevent and reduce churn.

A comprehensive churn assessment is useful to turn a reactive customer service into a proactive customer success. With detailed customer churn analytics, you don’t have to scramble to win back customers who have already decided to leave. Instead, you can divert your resources towards at-risk customers and prevent churn before it happens.

Related: What Does Churn Mean in Business? | Types & Importance

Types of Customer Churn

Before we discuss the detailed methods, techniques, and steps of churn analysis, it is important to be familiar with the key types of customer churn.

It is important to acknowledge that every type of churn hurts because every departing customer takes revenue with them. It also wastes your investment in acquiring the customers.

Moreover, high churn rates create a vicious cycle where your business has to continuously replace departing customers instead of focusing on growth. Interestingly, research shows that improving customer retention by just 5% can boost profits by 25% to 95%.

Hence, understanding the different types of churn is the foundation of churn analysis to help you develop targeted strategies.

1. Voluntary Churn

It would not be wrong to say that voluntary churn is the most dangerous type of churn for businesses because it indicates that customers have made a conscious decision to leave your business. For SaaS businesses, voluntary churn often means that the client has gone through multiple steps to cancel their subscription.

Some of the common reasons behind voluntary churn are:

- Poor Product-Market Fit: Sometimes, businesses end up acquiring customers who were never truly aligned with their value proposition. These customers register due to your marketing, but your solution might not address their actual problems. Such churn typically happens within 30 to 90 days.

- Lack of Critical Feature: If a customer requests some particular feature to improve their experience and such a request is not fulfilled, voluntary churn is likely to happen. Moreover, SaaS churn analysis often reveals that feature-related churn increases when competitors launch features your product lacks.

- Failure to Fulfill a Need: A lot of people cancel their subscriptions to a SaaS tool or stop buying the services of a business just because they “couldn’t get it to work.” Your churn assessment should examine whether these customers failed due to product limitations or whether there are some gaps in product implementation.

Also Read: B2B SaaS Benchmarks: A Complete Guide

2. Competitive Churn

Customers are always evaluating alternatives for more features, better pricing structure, and greater value. As a result, competitive churn is quite common, where your customer might leave and opt to use your competitor in the same niche.

Competitive churn is common across all industries. For example, customer churn analysis in retail shows a pattern that during promotional periods, competitors aggressively court each other’s customer bases.

3. Passive Churn

Customer churn does not have to be dramatic, where they point out any shortcomings in your product. In fact, passive churn is quite prevalent, in which customers simply drift by lesser engagement, shorter sessions, or stop logins altogether. Such customers typically also don’t respond to customer support or marketing messages and don’t bother to continue when the renewal time comes. Passive churn typically makes up a huge part of the total churn of a business.

4. Payment-Related Churn

Payment-related churn is part of the involuntary churn. It includes payment issues like expired credit cards, payment method failures, or customers forgetting to update billing information. Many of these customers might be willing to continue using your services once their payment issue is resolved.

5. Natural Churn

Sometimes customers stop using a product or service because they have achieved what they wanted to. While this might seem like product success, it reveals an opportunity gap, demonstrating that your product cannot keep up with customers’ changing needs.

Why Customer Churn Analysis Matters?

No business should make the mistake of ignoring the importance of churn analysis. It is a critical business capability to gather information and thrive in competitive industries. Moreover, companies that are able to obtain customer churn analytics typically emerge stronger, even if their churn is high initially.

Here are the key reasons why customer churn analysis is important:

1. Identify Product’s Blind Spots

Churn assessment helps you determine what is working with the product and what is not. It reveals patterns that simple insights or customer feedback surveys often cannot reveal.

For instance, your churn analytics can show that customers who downgrade their plans are 3x more likely to churn within 90 days. Similarly, you might discover that customers who use your product’s API are likely to stick around 60% longer.

Such facts and figures are not just statistics to be put in a churn report. Instead, they are roadmaps for product development and upgrades.

2. Data-Driven Communication

Churn data analysis is useful to identify communication patterns that predict both customer success and failure. Your analysis can show that customers who receive personalized onboarding emails are 50% less likely to churn in their first month.

A major strength of customer churn analytics is in the fact that it can personalize at scale. You can gather data about a few subscribers or even a large base of clients. It helps you customize your communication based on churn risk factors and avoid sending generic messages.

3. Competitive Advantage

Customer churn analysis helps companies enjoy higher profitability as they can feel the customer’s pulse and implement strategies that can reduce churn. Moreover, even if the market is on a downturn, they can use churn analytics to create personalized customer retention offers.

4. Minimize the Cost of Ignoring Churn

Some companies ignore increasing churn and often consider it to be inconsequential, especially if it is a minor increase from 5% to 7%. However, this is a huge mistake as it can adversely impact your growth in the long run. Even a 2% increase in monthly churn means the number of lost customers is compounding with time, resulting in significant revenue loss.

Methods of Churn Analysis

Customer churn analysis is a highly versatile process. There is no one-size-fits-all approach because every business has unique customer behaviors.

Generally, the various churn analysis methods can be divided into two main categories:

1. Quantitative Methods

Quantitative churn methods are data-driven approaches that reveal patterns and trends that are typically not obvious from casual observation. Hence, these methods provide the statistical backbone for your customer retention strategies.

- Cohort Analysis: It segments customers based on shared characteristics, such as when they signed up, their industry, or their acquisition channel. It is useful to analyze how different customer segments behave over time.

- RFM Analysis: RFM (Recency, Frequency, Monetary) analysis segments customers based on their last interaction with your product, usage frequency, and generated revenue. This churn analytics method is used to identify high-value customers with declining engagement to deploy relevant retention strategies.

- Behavioral Pattern Analysis: It is a part of the modern churn data analysis techniques that examine subtle patterns pointing towards potential customer departures. Key factors analyzed are login frequency changes, feature adoption rates, customer support sentiment, and payment timing patterns.

2. Qualitative Methods

While numbers obtained via quantitative churn analysis methods are useful to know what’s happening, qualitative research is equally important to determine why it’s happening. These methods transform churn statistics and reports into actual human stories that the team can use to further improve the product and marketing strategies.

The key qualitative methods are:

- User Interviews: Interviews with customers who have already left, as well as with those who are at-risk but have not churned yet, reveal a lot of important information. These conversations show the emotional journey behind customer decisions to get familiar with things that churn data analytics might have missed.

- Usability Testing: Poor product usability is often the major cause of churn. Even if the customer does not directly say that a confusing interface is the reason behind their cancellation, they are still likely to abandon a product that cannot be properly navigated.

Overall, both quantitative and qualitative churn analysis methods are important to create a robust customer churn analysis workflow.

Churn Forecasting Techniques

Churn forecasting techniques are helpful to identify at-risk customers early before they actually stop using your products or services. These techniques involve analyzing the patterns in terms of customer behavior and usage.

The successful implementation of the following churn forecasting techniques can help you significantly reduce churn instead of reacting to it later:

- Logistic Regression: Predicts churn based on historical customer data.

- Decision Trees / Random Forests: Divide the customers into likely-to-stay vs. likely-to-leave segments.

- Survival Analysis: Provide an estimated time until a customer churns.

- Customer Health Scoring: Combines insights from product usage, support tickets, NPS, and other indicators into a unified risk score.

- Machine Learning Models (XGBoost, Neural Nets): Identify complex patterns in large datasets with the help of artificial intelligence and machine learning to predict churn with higher accuracy.

Ultimately, the goal of these churn analysis methods and techniques is to have actionable churn analytics and intervene early.

How to Perform Customer Churn Analysis: A Step-by-Step Guide

An effective churn analysis is a systematic approach that is all about following a framework that you can keep refining over time. Here are the key steps involved in a customer churn analysis process:

Step 1: Establish Your Foundation

Before you can analyze churn, you need to define what churn means for your business. For example, subscription businesses usually focus on cancellation rates and downgrades, while e-commerce stores track purchase frequency and customer lifetime patterns.

Keeping this definition in mind, set up your data collection infrastructure with clean, consistent information from user activity logs, support systems, payment records, and product usage analytics.

Remember that poor data leads to poor insights, which lead to poor retention strategies. So, you must make sure that you are using high-quality data for reliable churn analytics.

Step 2: Segment Your Customer Base

As discussed before, every churn is different due to varying customer behaviour. Losing a customer who pays $10/month requires different retention strategies than losing one who pays $10,000/month.

So, you need to segment your customer base based on factors like:

- Revenue Impact: It can include subcategories like high-value customers, growth customers, at-risk high-value, and low-value stable customers.

- Industry and Geography: Different sectors and regions have unique retention challenges and opportunities.

- Customer Behavior: You can categorize the customers into power users, casual users, struggling users, and expanding users, each requiring different retention approaches.

Step 3: Identify Specific Churn Patterns

Businesses also have to identify the specific churn patterns based on the major types of churn:

1. Early Stage vs Late Stage Churn

SaaS churn analysis typically shows two distinct patterns. Early-stage churn (within 90 days) usually indicates issues in onboarding or product-market fit problems. On the other hand, late-stage churn suggests the existence of a better competitor or evolving customer needs.

2. Voluntary vs. Involuntary Churn

Voluntary churn means the customers have made a conscious decision to stop using your products or services, typically due to pricing issues, feature gaps, or switching to competitors for better value. Innovative tactics like letting customers pause their subscriptions can reduce voluntary churn.

Involuntary churn, on the other hand, occurs due to payment failures or billing issues and is often easier to prevent with a unified payment integration ecosystem.

Step 4: Create Targeted Retention Strategies

Creating customer retention strategies is also an important part of the churn analysis process. It involves developing specific approaches based on different churn types and customer segments:

- High-value customers showing signs of potential churn: Personal outreach, customized training, exclusive features, flexible contracts.

- Customers facing usability issues: Better onboarding, one-on-one training, and better documentation.

- Price-sensitive customers: Discount offers, downgrade options, and flexible payment terms.

Related: 16 Effective SaaS Customer Retention Strategies

Step 5: Track and Monitor

Measuring and tracking the effectiveness of your retention strategies against your churn report baseline is vital to make the required changes from time to time. This step reveals if your efforts are actually reducing the churn rate.

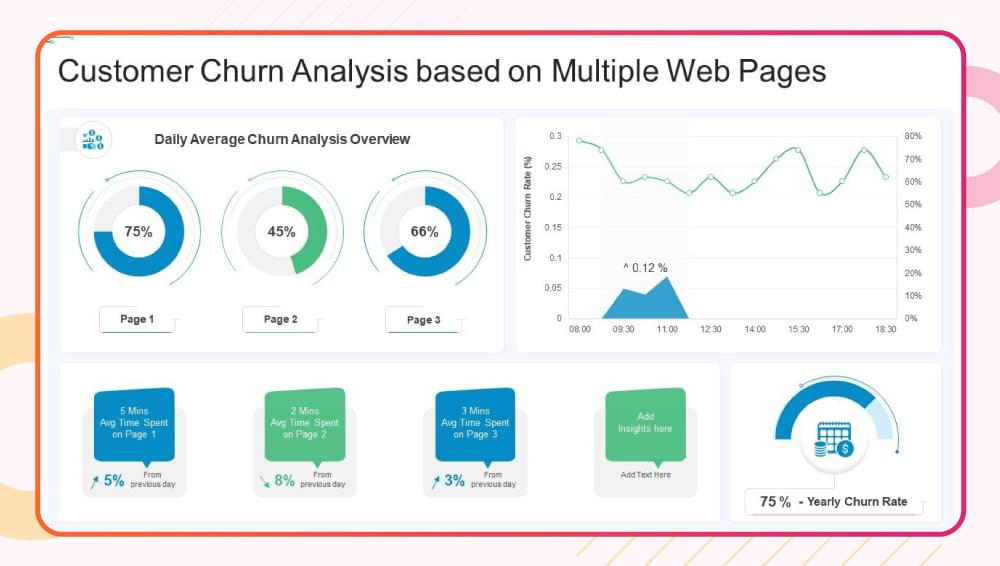

Customer Churn Metrics to Track

The following are some of the key churn-related metrics you should track:

1. Customer Churn Rate: The percentage of customers leaving during a specific time frame. Its formula is: (Customers Lost During Period ÷ Total Customers at Start of Period) × 100

2. Revenue Churn (MRR Churn): The percentage of recurring revenue lost due to churn. It is vital for subscription businesses and can be calculated with the following formula: (MRR Lost to Cancellations ÷ Total MRR at Start of Period) × 100

3. Net Revenue Retention (NRR): It shows whether expansion revenue, including upsells and cross-sells, is offsetting the churn rate. For example, if NRR is over 100%, it means your revenue is increasing even with churn.

4. Customer Lifetime Value (CLTV): Provide an estimated total revenue a customer is expected to generate before they churn. Higher churn rate results in a drop in CLTV, which should be concerning for businesses.

5. Product Usage: A drop in product’s feature usage, login frequency, and session lengths also indicates upcoming churn.

6. Customer Satisfaction Scores: Multiple customer satisfaction and loyalty score metrics can be tracked, such as:

- Net Promoter Score (NPS) to determine how likely customers are to recommend your product.

- Customer Satisfaction Score (CSAT) to gauge user happiness after specific interactions.

- Customer Effort Score (CES) to track how hard it is for customers to achieve a goal with your product.

7. Annual Contract Value (ACV): It represents the average annual revenue a business earns per customer contract. ACT is not directly a churn metric, but it is useful to get insights into the quality of lost customers and identify whether you are losing high-value customers. The ACV calculation formula is: Total Contract Value ÷ Contract Term in Years

Overall, obtaining customer churn analytics is a continuous process that requires regular monitoring and reviews to ensure your retention strategies remain relevant and effective.

Common Challenges of Churn Analysis (+ Solutions)

Customer churn analysis is certainly not a straightforward process. You are likely to face multiple obstacles in this process. Let’s discuss the most common ones, along with their solutions:

1. Unclear Definition of Churn

Since defining churn is different for every business model, many companies are not able to fully grasp the churn analysis process. Subscription businesses, for example, usually define cancellations as churn, but what about the downgrades?

The definition dilemma becomes even more prominent for customer churn analysis in retail, where it’s not clear whether a customer who has not purchased for a few months has churned or it is just a normal buying cycle.

Solution: Create multiple churn definitions as per your business model and document them to ensure the entire team is on the same page. For example, SaaS businesses should make it clear that downgrades are a type of revenue churn and not customer churn.

2. Data Quality Issues

Poor data quality can kill the entire churn data analysis process. These quality issues are normally reflected in incomplete customer profiles, a lack of tracking, or multiple data silos that make it difficult to draw concrete conclusions.

Solution: Implement strict data quality assurance processes and use multiple data collection tools for verification. You can also invest in a customer data platform to centralize the available information.

3. Resource Constraints

There is no doubt that customer churn analytics requires significant time and expertise. A lot of businesses underestimate the resources needed for meaningful churn analysis.

Solution: You should start with simple, high-impact insights using readily available tools like Churnfree. Moreover, focus on actionable analysis before investing in advanced capabilities to ensure your business has at least a basic churn analysis process in place.

Taking Action: Your Next Steps

Customer churn analysis is only valuable if you use it to take concrete action. So, you should start today with your biggest churn drivers and use tools like Churnfree for effective churn analytics that contributes towards revenue as well as long-term growth.

Remember, churn analysis is an ongoing process, so you should continuously refine it to master customer retention and build valuable customer relationships.