Gross vs Net Retention (Revenue Retention)

People in the startup world often mix up the term “gross vs net retention.” But business owners should know there’s a big difference between these two terms.

So what’s the difference between gross and net retention? Gross retention shows the percentage of customers who stay active (recurring revenue) over a set time. In other words, it tells you how many customers still use your product or service after a specific period.

Net retention looks at both gross retention and customer churn (the percentage of customers who quit using your product or service i.e downgrades, cross-sells and upsells). So, while gross retention counts how many customers remain active, net retention also measures the extra money from upgrades of customers as time passes.

You typically want your net retention to exceed your gross retention. If it doesn’t, you’re losing more customers than you’re gaining, which no business can keep up long-term.

How Net vs Gross Retention relates to Customer Acquisition Cost (CAC):

- Lower CAC often has a connection to higher NRR because companies need to spend less to get customers. This allows them to put more money into keeping and growing their customer base.

- On the flip side, high CAC can push companies to keep their GRR and NRR high to make up for the cost of getting new customers. This often leads to more aggressive customer success and upselling tactics.

What is net retention?

Net retention monitors the revenue a company gains and loses in a month or year. It’s a key metric for subscription businesses as it measures the money a company keeps from its customers over time. A high net retention rate shows the company does a good job of keeping its customers and growing its business.

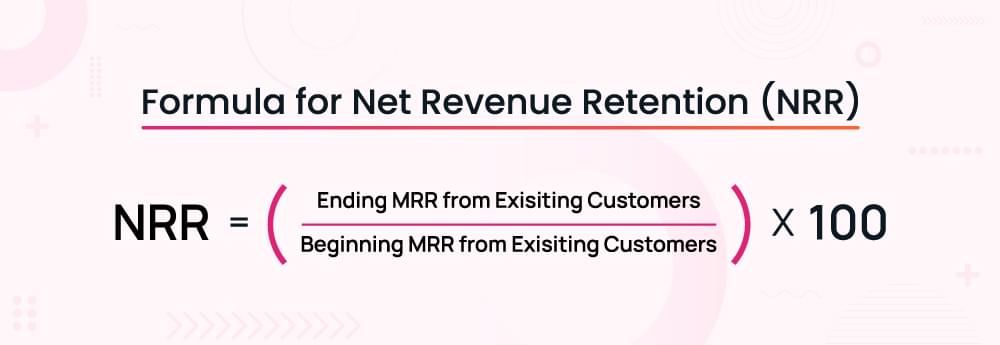

How to calculate net retention revenue?

There are several ways to figure out net retention, but the most common one is to take the total revenue at the end of a period and subtract any lost revenue. Churned revenue means any money lost during the period because customers left. Here’s the NRR formula:

Let’s look at an example. Company ABC had $100,000 in recurring revenue at the end of January. In February, three customers canceled their subscriptions, which led to $10,000 in lost revenue. So, Company ABC’s net retention rate for February would be 90% (($100,000 - $10,000) / $100,000).

The net retention calculation can show you how to keep your current customers. But it doesn’t tell you everything. For instance, if your company has a high net retention rate but a low gross margin, it might not last long.

On the other hand, if your company has a low net retention rate but a high gross margin and low costs to get new customers, it might still grow well. Like all numbers, it’s key to see net retention in context and use it as just one piece of info when you’re making choices about your business.

What is Gross Retention?

Gross retention is the percentage of revenue a company retains from its customers. In other words, it measures how much money a company keeps from its money. Gross retention matters because it hints at a company’s growth.

A business with high gross retention holds onto most of its customers and sees its monthly earnings go up also reducing employee churn. On the other hand, if a company has a low gross retention rate, they’re losing customers and not making as much money from them each month.

High gross retention also points to a company having products or services that stick. This means once folks start using them, they don’t quit (or they use them so much they’re okay paying more each month). This proves valuable because companies with sticky offerings find it easier to get new users. They know these users will stay and keep paying for their product or service over time.

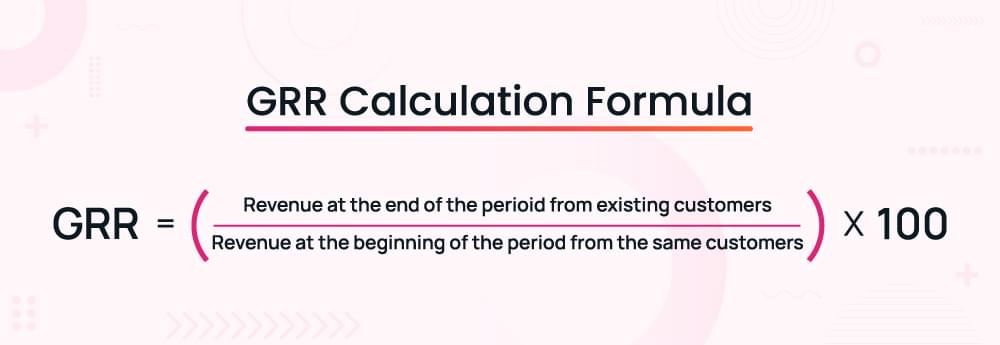

How to calculate Gross retention revenue?

There are two ways to calculate gross retention: The first way is to take the monthly recurring revenue (MRR) and divide it by the previous month’s MRR. This will give you your gross retention rate for that month. The second way is to take the total revenue (usually 12 months) and divide it by the total number of customers at the beginning of that period. This will give you your average gross retention rate over time.

Gross Retention Example:

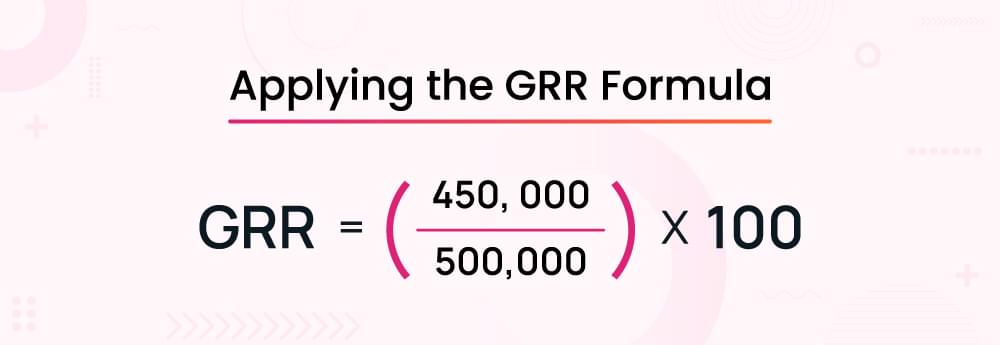

Let’s use this data for a company:

- Beginning MRR: $500,000 (money from existing customers at the start)

- Churned MRR: $30,000 (money lost when customers left)

- Downgrade MRR: $20,000 (money lost when customers switched to cheaper plans)

How to Calculate the End MRR from Existing Customers:

End MRR from Existing Customers=Beginning MRR−Churned MRR−Downgrade MRR

End MRR from Existing Customers=500,000−30,000−20,000=450,000

GRR=0.90×100=90%

A GRR of 90% shows the company has kept 90% of its revenue from its existing customers over the period. This points to a 10% revenue loss because of churn and downgrades.

Calculate Monthly GRR:

If you need to figure out a monthly GRR, you can tweak the same formula for a shorter timeframe:

- Beginning MRR for January: $100,000

- Churned MRR in January: $5,000

- Downgrade MRR in January: $2,000

End MRR from Existing Customers in January=100,000−5,000−2,000=93,000

Monthly GRR=93%

You can apply this method each month, but keep in mind that GRR makes more sense over extended timeframes yearly to factor in more steady trends and patterns in customer loyalty and revenue stability.

Gross Revenue retention formula:*

How to maintain a perfect balance between net retention vs gross retention for any business?

The answer is it depends. A high NRR with a low GRR means you keep your customers, but they don’t spend much. Alow NRR with a high GRR indicates you lose customers , but those who stay spend a lot.

You want high NRR and high GRR. But if you had to choose one to concentrate on, it would depend on your business model and goals.

GRR is often lower in high-churn industries like consumer SaaS, while NRR can be significantly higher in B2B SaaS with strong expansion revenue.

Take, for instance, if you sell products or services that last a long time (software or subscription-based tools). In this case, NRR becomes the priority because once someone buys from you, they’ll likely use your product for a while.

On the flip side, if you sell physical goods that need frequent replacement (like clothes or electronics) then GRR becomes more important. Even though people might not buy from you every month when they do shop, they’ll spend more.

Moreover, While net revenue retention offers a holistic view, gross revenue retention should not be overlooked, particularly for business operators and analysts.

For marketers, looking at both gross and net revenue retention can give you useful insights. Gross revenue retention shows how well a company’s main product or service is doing, while net revenue retention tells you how appealing and effective their extra services or offerings are.

Choose your combination for net retention vs gross retention accordingly!

Net retention vs gross retention—Which matters more in SaaS business?

As a SaaS business, you need to focus on net retention to predict future growth. Net retention gives a better picture of customer satisfaction and loyalty by looking at both new and lost customers. When your net retention rate is high, it shows that customers like your product and stay with you for a long time.

Putting effort into improving net retention can boost your profits. Just think - a 1% increase in your net retention rate could mean an extra $1 million in yearly revenue!

When we compare gross vs net retention, why does net retention matter more? It’s because it shows how loyal your customers are. Customers who choose to stay even when they could leave are more likely to support your brand. They’re also more likely to upgrade to pricier plans as your company grows.

This doesn’t mean gross retention isn’t important - it is! If you can’t keep your current customers active, you won’t have new ones to replace them. But if you want to measure customer loyalty and see how much you can grow net retention is the way to go.

Bottom-line:

Tracking gross retention vs net retention isn’t just an end in itself. Still, it plays an important role in enhancing customer and revenue retention.

Churnfree automates your calculations to help keep customers and increase revenue. Watch a demo to see how it aids your decision between net retention and gross retention for your company. Understanding the correct churn rate shows you how many customers leave, but picking between net vs gross retention helps you win them back and keep existing customers longer.

Churnfree does the math for you based on what you need. Once you have the correct figures on net retention vs gross retention, you’ll understand how to boost customer and revenue retention and make smarter business choices.

Tracking net retention vs gross retention isn’t just an end in itself. Still, it plays an important role in enhancing customer and revenue retention.

Related Reads:

B2B SaaS Churn Rate Benchmarks

Average Churn rate for subscription services

FAQs

How do you differentiate between net retention vs gross retention?

Maintaining the balance between gross vs net retention can be a challenge for some businesses for some time.

NRR is the percentage of customers who stay with a company over a given period.

GRR is the percentage of customers’ total spending that stays with a company over a given period.

How do you calculate gross revenue retention vs net revenue retention?

Use gross retention vs net retention formula. To calculate gross retention, you divide the number of customers at the end of a specific time period by the number of customers at the beginning. For example, if you had 100 customers at the start of January and 90 customers at the end, your gross retention would be 90%.

To calculate net revenue retention, you subtract the recurring revenue lost from customers during a period from the total recurring revenue at the end of that period. Then, you divide this result by the total recurring revenue at the beginning of the same period.

Can net retention be lower than gross?

Yes, your net retention might fall below your gross retention for several reasons. Your churn rate could climb if your product fails to meet customer expectations or if you’re not doing enough to keep your current customers interested. If you notice your net retention dropping under your gross retention, you need to tackle this problem.

What is the main difference between NRR and GRR?

The key difference between net revenue retention (NRR) and gross revenue retention (GRR) is in what they measure. GRR looks at the money from customers who stay subscribed during a certain time ignoring any changes from downgrades or upgrades. NRR, on the other hand, gives a bigger picture. It factors in money changes due to customer losses, downgrades, and upgrades showing how well a company can generate revenue overall.