Top 11 Customer Retention Metrics | Measure Success KPIs

Tired of customers leaving your business? Or maybe, you simply want to know how exactly you can measure retention and success key performance indicators (KPIs) in your company. This process involves analyzing and tracking different customer retention metrics.

This comprehensive guide will tell you about the top 11 customer retention metrics you can use to measure success KPIs and make sure you are on the right track to reduce churn.

Table of Contents

- 1. Customer Retention Rate (CRR)

- 2. Customer Churn Rate

- 3. Repeat Purchase Rate (RPR)

- 4. Customer Lifetime Value (CLV)

- 5. Annual Contract Value (ACV)

- 6. Net Promoter Score (NPS)

- 7. Product Return Rate

- 8. Loyal Customer Rate

- 9. Existing Customer Growth Rate

- 10. Days Sales Outstanding (DSO)

- 11. Time Between Purchases

- Conclusion

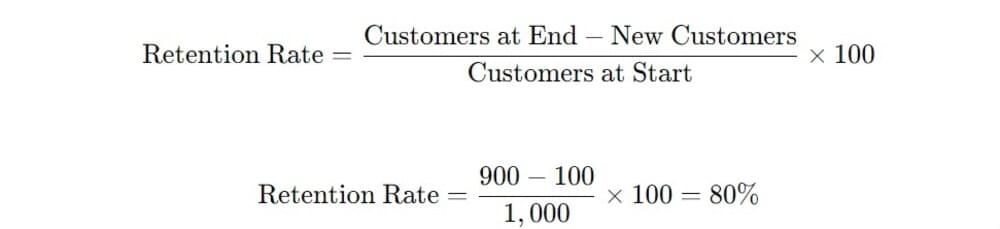

1. Customer Retention Rate (CRR)

Customer retention rate is the most fundamental customer retention metric. It measures the percentage of customers a business retains over a specific period.

This customer success KPI provides quick and accurate insight into customer loyalty and business health.

Formula:

CRR = ((E-N)/S) × 100

- E = customers at end of period

- N = new customers acquired during period

- S = customers at start of period

Importance

Customer retention rate is the baseline metric, as it affects all of the other customer retention metrics. A high CRR means strong product-market fit and successful retention strategies. The overall industry benchmarks vary significantly, but SaaS customer retention rates are anywhere in the range of 85-95% annually for well-known companies.

2. Customer Churn Rate

Customer churn rate means the percentage of customers who stop using the products or services of a business during a specific period. It is the opposite of the retention rate metric. Customer churn rate provides important data about customer dissatisfaction and business vulnerabilities.

A high churn rate means customers are not happy with the quality of your products or services, so suitable steps must be taken to reduce churn.

Formula:

Churn Rate = (Customers Lost During Period / Total Customers at Start of Period) × 100

Importance:

Understanding churn patterns is useful to:

- Identify at-risk customer segments

- Optimize retention efforts

High churn rates indicate underlying issues with product satisfaction, customer experience, or competitive positioning. Subscription-based businesses, especially, can increase their revenue significantly by reducing churn even by a small percentage.

If you are suffering from a high churn, you should consider signing-up on Churnfree. It is a powerful customer retention software that can help you achieve zero churn by building custom cancel flows, offering personalized offers, managing multiple websites, and many other features

3. Repeat Purchase Rate (RPR)

Repeat purchase rate means the percentage of customers who make additional purchases after their initial transaction. E-commerce and retail businesses can use this customer retention KPI to build long-lasting relationships with their customers.

Formula:

RPR = (Customers Making Repeat Purchases / Total Customers) × 100

Importance

A high repeat purchase rate means strong customer satisfaction and successful cross-selling strategies that are making customers buy different things. Moreover, this metric is linked with customer lifetime value, which offers reliable data about product quality, customer loyalty, and experience.

Generally, businesses with strong RPR also have higher profit margins. Such businesses are also able to enjoy stable revenue streams.

Optimization of RPR includes targeting past customers with personalized email marketing campaigns and introducing loyalty programs to encourage repeat purchases.

4. Customer Lifetime Value (CLV)

Customer lifetime value means the total revenue a business can generate from a single customer. This KPI is composed of several components, like purchase frequency, average order value, and customer lifespan.

Formula:

CLV = (Average Order Value × Purchase Frequency × Customer Lifespan)

Importance:

CLV helps businesses make data-driven decisions about:

- customer acquisition costs

- retention investments

- Allocating resources in the right places.

It also helps businesses understand which customer segments are providing the highest lifetime value. As a result, they can implement targeted marketing campaigns and personalized retention strategies.

A company with strong customer lifetime value means it is better than its competitors in terms of profitability and growth.

5. Annual Contract Value (ACV)

Annual contract value is the average revenue generated from customer contracts on an annual basis. This customer success KPI is highly relevant for B2B companies, SaaS platforms, and subscription-based businesses that focus on long-term commitments with customers.

Formula:

ACV = Total Contract Value / Contract Duration in Years

Importance

ACV is a representation of customer loyalty levels, suitability of pricing levels, and revenue predictability. Higher ACV means stronger customer relationships with high-value customers. It also represents better product-market fit and effective upselling strategies. SaaS companies can typically increase ACV by focusing on acquiring new customers.

6. Net Promoter Score (NPS)

Net promoter score is the measurement of customer satisfaction and loyalty by directly asking customers how likely they are to recommend your business to others on a scale of 0-10. It is a popular customer retention metric to gather data about customer sentiment and future retention probability.

Formula

NPS = % Promoters (9-10) - % Detractors (0-6)

Importance:

NPS is one of the leading indicators of customer retention and business growth. Customers providing high NPS scores mean they are more likely to remain loyal and make repeat purchases. Moreover, they are likely to generate positive word-of-mouth marketing.

7. Product Return Rate

Product return rate is the percentage of sold products that customers return within a specific period. This customer retention KPI provides data about product quality, customer expectations, and post-purchase satisfaction.

Formula:

Return Rate = (Number of Products Returned / Total Products Sold) × 100

Importance

High return rates mean there are some issues with the product, or you are making misleading claims in your marketing campaigns. Keep in mind that some returns are inevitable, but monitoring this metric will help you identify improvement opportunities and prevent customer dissatisfaction that could impact future retention.

8. Loyal Customer Rate

Loyal customer rate represents the percentage of customers who consistently choose your business over competitors. This customer retention metric is much more than simple repeat purchases, as it indicates true customer loyalty and advocacy.

Formula:

Loyal Customer Rate = (Number of Loyal Customers / Total Customer Base) × 100

Importance

Loyal customers are the backbone of any business because they provide:

- the most predictable revenue

- highest lifetime value

- strongest word-of-mouth marketing.

Moreover, they are more forgiving of occasional issues and more likely to try new products or services. Every business should focus on building a strong base of loyal customers to enjoy sustainable growth opportunities.

9. Existing Customer Growth Rate

Existing customer growth rate represents the increase in revenue from current customers through upselling, cross-selling, and usage increases.

This customer success KPI indicates the effectiveness of account management and customer success strategies.

Formula:

Existing Customer Growth Rate = ((Current Period Revenue from Existing Customers - Previous Period Revenue from Existing Customers) / Previous Period Revenue from Existing Customers) × 100

Importance

Increasing revenue from existing customers is much more cost-effective than acquiring new customers. This customer success metric indicates successful initiatives, such as upselling strategies. Moreover, high existing customer growth rates signal healthy retention and expansion opportunities.

10. Days Sales Outstanding (DSO)

Days sales outstanding is the measurement of the average number of days it takes to collect payment after a sale is made. It is primarily a financial metric, but it has an impact on customer retention by indicating payment behavior and potential financial stress among customers.

Formula:

DSO = (Average Accounts Receivable / Total Credit Sales) × Number of Days in Period

Importance

Extended payment delays mean financial difficulties, operational issues, or general dissatisfaction among customers. Moreover, monitoring DSO is vital to identify at-risk customers early and ensure proactive intervention. Shorter DSO can significantly improve cash flow and allow the company to make better customer retention investments.

11. Time Between Purchases

Time between purchases measures the average number of days a customer takes before making another purchase. It is typically calculated within a year-long period. This customer retention KPI is useful to predict future customer behavior. Also, it can be used to identify suitable intervention opportunities for better marketing and retention.

Formula:

Time Between Purchases = Total Days Between All Repeat Purchases / Number of Repeat Purchase Intervals

Importance

Analyzing and understanding the purchasing behaviour of customers is useful for more efficient inventory management and strategic marketing. It also improves customer outreach strategies.

Generally, long intervals between purchases indicate declining customer engagement. On the other hand, a shorter interval means higher customer satisfaction and loyalty.

Also read: Customer Retention Analytics 101: A Complete Guide

Conclusion

Overall, being familiar with the top customer retention metrics is the key to build a sustainable and profitable business.

By tracking and understanding the 11 customer success KPIs discussed in this article, businesses can optimize retention strategies and build long-lasting customer relationships. Most importantly, you can try out Churnfree, a customer retention software, that can help you minimize churn and maximize customer success and retention.