10 Scalable Benefits of Monthly Recurring Revenue (MRR)

Metrics are the key performers when evaluating business success and teams’ contributions. But which sales metrics reflect the most significant business impact? Are there specific ones you should give priority?

One metric that you should investigate is monthly recurring revenue (MRR). It’s the lifeblood of SaaS business and helps you strengthen your business firm’s backbone.

It tells you and your teams how much income is generated every month. You can swipe up each month’s MRR reports to evaluate the business growth, the performance of products and services, and customer retention rate.

An MRR analysis discloses if your revenue is shrinking or growing over time. Moreover, it helps sales teams make informed decisions.

What is Monthly Recurring Revenue?

MRR is a metric that measures the amount of money that a company receives every month from its subscribers or customers. This sales metric includes all forms of recurring revenue, such as subscription fees, membership dues, and service contracts.

It’s an essential sales metric for businesses because it indicates the stability and growth of their customer base. A high MRR means that a company has many loyal customers willing to pay for its products or services regularly. Conversely, a low MRR means a trouble ahead, as it may mean that customers are canceling their subscriptions or not renewing their contracts.

How to Create a Monthly Recurring Revenue?

There are a few key things that can help you boost monthly recurring revenue for your business. Initially, you may need to identify your target market and determine the price your customers may be willing to pay for every month. Once you know the market value of your products, you can upgrade your products and services to meet the users’ needs and start marketing accordingly.

There are several ways to increase recurring revenue.

Enhance your products or services prices, carefully. Nevertheless, it is not always achievable.

Offer new products or services that customers can subscribe to monthly to boost MRR.

Increase your customer base by acquiring new subscribers through marketing and sales efforts.

Set up a billing system so customers can pay smoothly. It can involve setting up a subscription plan with a payment processor like PayPal or Stripe or automatic payments through your website or shopping cart system. Whichever method you choose, make sure it’s easy for customers to understand and use and they may not get frustrated and cancel their subscriptions.

Finally, keep track of your monthly recurring revenue to see how your business grows over time. It will help you make necessary adjustments along the way and ensure that your business is on track to reach its goals.

No matter how you choose to increase your recurring revenue, it’s essential to keep track of monthly revenue can help you gauge your efforts’ success over time.

Does Generating Recurring Revenue Help your Business?

The key to generating recurring revenue is creating value for your customers that they are willing to pay for on an ongoing basis. It could also mean, be as simple as providing access to exclusive content, discounts, or something more significant, like providing a service that helps save them time or money. Whatever it is, it needs to be something your customers see worth paying for month after month.

Suppose you can create value for your customers and get them to sign up for a recurring payment plan. In that case, you’ll have made a valuable asset for your business that will provide long-term stability and growth potential.

What are Examples of Recurring Revenue?

Recurring revenue is a regular income that can come on a daily, weekly, monthly, or even yearly basis. The key element here is that it’s something that happens regularly.

There are all sorts of businesses that have recurring revenue streams. For example, many gyms and fitness clubs rely heavily on monthly membership fees as their primary source of income. It gives them a predictable amount of money every month, which they can use to cover their spending and keep the business running smoothly.

If you’re thinking about starting a business, or if you’re already running one, consider ways that you could incorporate recurring revenue into your model! Recurring revenue can be beneficial for companies of all sizes. It provides a stable source of income that can be counted on, which makes it easier to manage expenses and plan for the future.

Five best Examples of Recurring Revenue?

Netflix

Netflix is an excellent example of recurring revenue. For just $7.99 per month, you can watch TV shows and movies whenever you want. There are no commercials, and you can cancel anytime. Plus, there’s always something new to watch since they add new content every month.

Spotify

Spotify is another great example of monthly recurring revenue. For just $9.99 per month, you can listen to any song you want, anytime you want, without any ads interrupting your music experience. You can also create customized playlists of all favorite songs and listen offline if you upgrade to their premium subscription for $14.99 per month..

Adobe Creative Cloud

Adobe Creative Cloud is a software suite that gives users access to all of Adobe’s creative apps like Photoshop, Illustrator, and InDesign for just $19.99 per month (or $9.99 per month if you’re a student). Its is a wonderful option for people who need access to professional-grade design tools but don’t want to spend on the high price tag for individual software programs..

G Suite by Google Cloud

G Suite by Google Cloud is a set of productivity tools that includes Gmail, Docs, Drive, Calendar, and more – all designed specifically for businesses (though individuals can use it too). It starts at just $5 per user/month (billed annually), making it an affordable option for small businesses.

Apple Music

Apple Music is an excellent streaming service that provides access to over 50 million songs for just $9.99 per month ($14.99 per family plan up to 6 people). With Apple Music, you can create custom playlists or listen to curated ones made by experts.

What is a Good Monthly Recurring Revenue?

There cannot be a one-size-fits-all solution to this query, as the amount of monthly recurring revenue (MRR) considered “good” would vary depending on your specific business goals and circumstances. However, as a general guideline, you may want to aim for an MRR that covers your basic costs of operation and leaves room for profit.

For example, let’s say your monthly expenses total $5,000. In this scenario, you would ideally want to generate at least $6,000 in MRR to have a buffer of $1,000 to cover unexpected expenses or invest in growth initiatives.

Of course, the amount of MRR you need to achieve your desired level of profitability will also depend on your pricing strategy and the margins you’re aiming for. If you’re selling high-priced products or services with large margins, you won’t need as much MRR to reach your financial goals. Conversely, if you’re selling lower-priced items with slim margins, you’ll need to generate more MRR to meet ends.

The bottom line is that there is no magic number of recurring revenue. The best way to determine how much MRR is right for your business is to consider your operating costs and desired profits carefully, then set realistic sales goals accordingly.

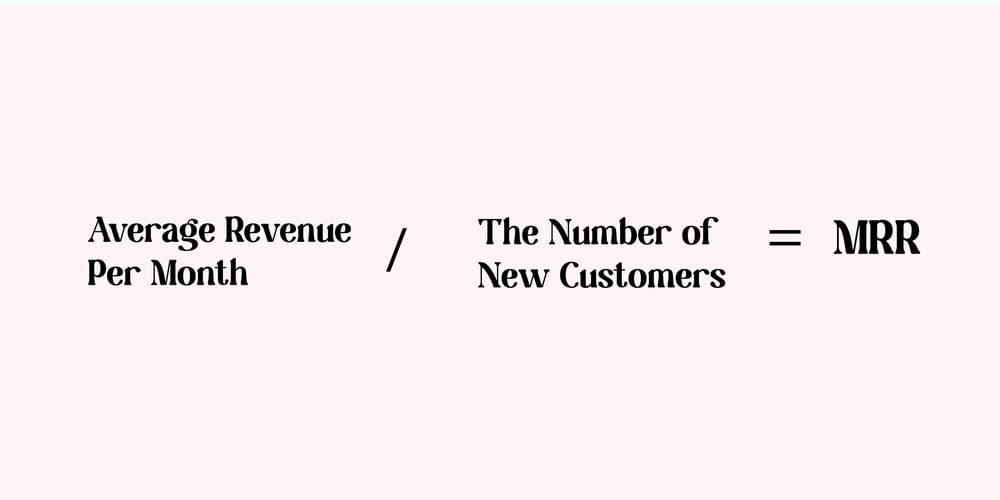

How do you Measure Monthly Recurring Revenue?

There are several ways to measure recurring revenue (MRR). The most common way is to take the recurring revenue and divide it by the number of customers. This will give you the average MRR per customer.

You could also look at it from a lifetime value perspective. If your average customer spends $100 with you each month, their lifetime value would be $1,200 ($100 x 12 months). You could also use this same method to calculate an expected monthly churn rate.

10 Benefits of Monthly Recurring Revenue

#1. Increased Revenue

The most apparent benefit of MRR is that it can help you increase your overall revenue. With MRR, you can generate a consistent income stream each month, which can help you grow your business.

#2. Predictable Income

A predictable income stream means clearer insight into budgeting and forecasting for your business. With MRR, you know exactly how much revenue you’ll be bringing in each month, making it easier to plan for expenses.

#3. Improved Cash Flow

Improved cash flow means with MRR, you receive monthly payments from customers, helping you with short-term cash flow needs and making managing your finances easier.

#4. Reduced Churn

Churn is the percentage of users who cancel their subscription or stop using your product or service over some time. They may likely to stick around and continue using your product if they’re paying a recurring fee. MRR can help reduce churn by giving customers a reason to keep using your product or service each month.

#5. Improved Customer Lifetime Value

Customer lifetime value (CLV) is the total amount of money a customer spends with your company over their relationship with you. The longer they continue using your products, the more they will spend, and their CLV will be higher. MRR can help improve CLV because it gives customers a reason to keep using your product or service month after month.

#6. Easier to Upsell and Cross-Sell

Upselling is when you offer a user a more costly version of your product or service. Cross-selling is when you offer a user complementary products or services. Both upselling and cross-selling can be easier with MRR because customers are already paying a recurring fee. They’re more likely to be open to spending more money on products or services that they’re already using and happy with.

#7. Increased Customer Retention

Customer retention is the percentage of customers who continue using your product or service over time. MRR can help increase customer retention because it gives customers a reason to keep using your product or service each month. They may likely to stick around and continue using your product if they’re paying a recurring fee.

#8. Improved Customer Satisfaction

Customer satisfaction is the percentage of happy customers with your product or service. MRR can help improve customer satisfaction by giving customers a reason to keep using your product or service each month. If they’re paying a recurring fee, they’re more likely to be satisfied with your product since they’re getting value from it each month.

#9. Increased Customer Loyalty

Customer loyalty is the percentage of customers who continue using your product or service over time and recommend it to others. MRR can help increase customer loyalty because it gives customers a reason to keep using your product or service each month. They may likely to be loyal to your product if they’re paying a recurring fee since they’re getting value from it each month.

#10. Scalability

Scalability is the ability of your business to grow and handle increased demand without compromising quality or service levels. MRR can help improve scalability because it provides a consistent stream of income that can help fund growth initiatives. With MRR, you know exactly how much revenue you’ll be bringing in each month, making it easier to plan for expansion.

The Bottom-Line:

Metrics are just numbers and do not explain everything, but they help to make informed business decisions. Instead of getting stuck in the day-to-day blips, focus on historical trends to predict better. AI-based toolshelp you focus on historical trends and future predictions instead of wasting time on numbers that offer a little value.